Getting past the headlines from today’s Policy Exchange report on higher level and technical education reveals an interesting report that sets out some of the significant challenges that we as a country face if we are to meet future high level skills needs and keep pace with competitors. It does, however, set up some false distinctions and unhelpfully puts different parts of the education system at odds with each other.

My colleague Karmjit Kaur gives the university perspective on this in her blog elsewhere on this site. What I want to do here is address the specific issue raised in the report about universities’ reserves. In summary the narrative is that universities have been building up cash reserves based on a bonanza of fee income, so can’t we encourage them to spend it and redistribute some of the funding they continue to receive from the public purse? After all isn’t this just money sitting around in the banks?

The trouble with this outlook is that it fails to really understand the significant changes that have been taking place in the sector over the last five years and what is required to run a university in this day and age (or indeed what is required to run any large complex business).

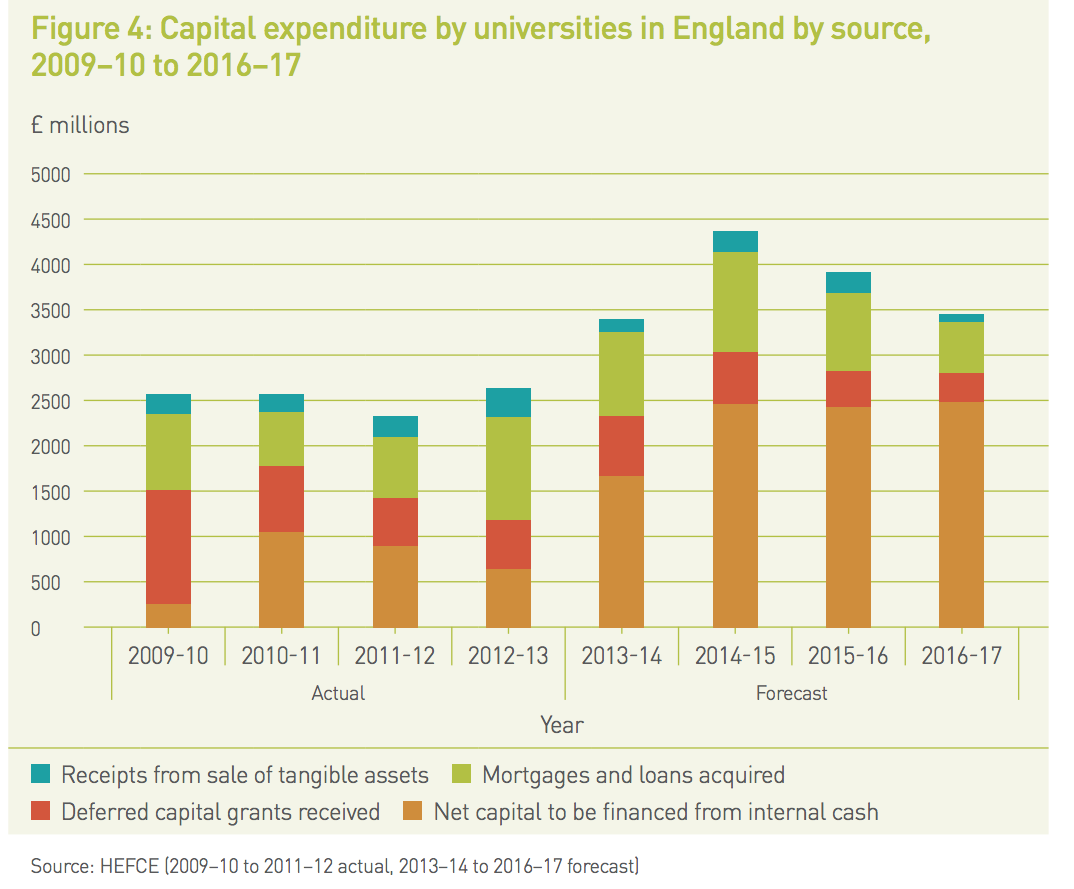

As set out in UUK’s submission to the Spending Review, the composition of university income has changed considerably since the 2010 Spending Review. In England, the introduction of higher tuition fees led to significant reduction in public teaching grants. Since the implementation of the new funding system, the proportion of teaching income the sector receives from grants has decreased from 66% in 2011-12 to 17% in 2015-16. In addition, public funding for capital grants decreased by 85% between 2009-10 and 2012-13.

HEFCE has estimated that the cumulative reduction in capital funding for the sector between 2009-10 and 2013-14 (including teaching and research) was around £3.5 billion. It’s not entirely clear whether the Policy Exchange report understands this factor when looking at the rise in overall levels of income for teaching. In spite of these reductions, universities have been able to sustain investment in capital through internal resources. This has allowed investment in teaching infrastructure and the student experience, which is evidenced by a majority of students continuing to express overall satisfaction with their course through the National Student Survey.

How has this been achieved? Many institutions have used commercial borrowing, bonds and internal cash reserves to finance capital projects and make up for a decline in public funding. Their ability to do so hinges on their ability to generate a surplus, both for direct financing and to support borrowing. This is the way any effective business works and many institutions are finding this headroom for investment through finding efficiencies.

Having said that, there are challenges ahead, as have been pointed out by HEFCE. The level of surpluses varies significantly between institutions and the level of surplus across the sector is falling, from a peak of 4.8% of total income in 2010-11, to 4.3% in 2013-14. This indicates that a significant proportion of institutions may have to reduce capital expenditure in the future.

The two graphs below, taken from the Universities UK work on efficiency in the HE sector, show firstly how capital investment has changed in the sector and secondly the relationship with surpluses and the challenges for sustaining this. The idea that this is just money sitting in the bank, or can simply be used to replace strategic public investments in those areas where there is a public good (supporting access or sustaining strategic or high cost subjects), fails to really understand what is going on.

The sort of shift suggested in the Policy Exchange report, if implemented, would be a sure fire way of undermining the effectiveness of the sector. Also, the suggestion that any remaining grant funding in this area should be directed towards universities with the smallest financial reserves, does also beg the question of whether it would effectively reward those that have not found efficiencies or managed their finances strategically to find room for investment.

The sort of shift suggested in the Policy Exchange report, if implemented, would be a sure fire way of undermining the effectiveness of the sector. Also, the suggestion that any remaining grant funding in this area should be directed towards universities with the smallest financial reserves, does also beg the question of whether it would effectively reward those that have not found efficiencies or managed their finances strategically to find room for investment.

The out-dated views of university financial management in the Policy Exchange report, do, however, highlight that we as a sector have a long way to go to demonstrate how far we’ve come.