Last week saw two Conservative MPs -Sally-Ann Hart (Hastings and Rye) and Andrew Griffith (Arundel and South Downs) – call for fee and rent reductions for current students.

Neither of these MPs could be described as being on the left (or even the centre) of the party – Hart famously didn’t want to guarantee workers with learning difficulties a minimum wage and has been investigated after incidents of apparent antisemitism and Islamophobia, Griffith was chair of the Centre for Policy Studies.

On the face of it, this is two MPs calling for a deviation from government policy. And the Johnson administration makes up in message discipline what it lacks in, well, broad competence – so when stuff like this happens it is worth paying attention to. It signifies that constituent concerns are starting to cut through – and the public mood is shifting. Polling backs this up – the consensus in the UK is that students have had, and continue to have, a hard time of it.

The default position

Beleaguered Secretary of State for Education Gavin Williamson has made his own position clear – if higher education providers are unable to provide a “quality” experience then they should refund fees. The uncontroversial action of consumer law. He’s been less keen to make a similar argument on rental – though in many cases (provider owned accommodation and the larger private purpose-build providers) this is beginning to happen as it did in the summer term.

The Office for Students has just doubled down on this – providers are asked to recheck whether what was promised to students is what is now available. If this doesn’t match up, the expectation is that providers:

actively consider their obligations under consumer law for refunds or other forms of redress

To me, this position ignores the fact that, fundamentally, the pandemic and associated restrictions on travel and socialisation affects all students. It may affect some more than others, and it may play out in different ways in different situations – but there is no argument that the overwhelming majority of issues faced by students are due to Covid-19, not choices made by providers.

What students are asking for

There’s three overlapping points of pressure – fee refunds, accommodation refunds, and in-year support.

The fee refunds discourse is the longest lived – variations of the arguments deployed here have been used since 1998. It is suggested that because of the move to online learning fees should be lowered or scrapped, a move that would only have an impact after graduation and would disproportionately benefit graduates that earned more. Providers are able to unilaterally lower fees, which would reduce (or, this term, claw back) income from the Student Loans Company – but as providers are not spending less money this would introduce a new detriment to the student experience.

On accommodation refunds (or discounts) the nub of the argument is that students are paying for a service they are unable to use – the majority of students have been asked by government to stay where they are, though a fair number have returned to their term time address anyway. The fragmented and largely unregulated nature of the student accommodation market means that the decision to reduce or waive rent will need to be made independently – there’s no way to do this nationally without specific (and out of character) legislation.

Enhanced in-year maintenance support would partially address the rent issue, but would also recognise that term-time work is hard to come by (the traditional student roles in the hospitality industry are just not possible) and that families that could otherwise support students may be facing income pressures. Universities have made hardship funds available (and these saw a very modest £20m top up via DfE over the turn of the year) but there would also be an argument for additional maintenance payments (as either grants or loans) flowing via SLC.

Fees

On fees and rent dealing with refunds means that for students to benefit universities or accommodation providers will lose out. Though students obviously have our sympathy – the other part of the equations have short and long term impacts we need to consider.

Let’s start with fees. Though universities are teaching online rather than on campus this doesn’t affect their spending. Student fees cover, in the main, academic and support staff salaries – a reduction in fee income means (as we’ve already seen in some poorly recruiting providers this year) staff redundancies, a drop in sessional staff numbers, and (in extremis) the closure of courses, departments, or even providers. A decision to give graduates money off in 2023 and beyond would have a detrimental short term impact on the student experience – if you are only getting a few hours a week in contact time, how much less would you get with fewer tutors available? If you are waiting too long to access busy support service, how much longer would you wait when funding is cut?

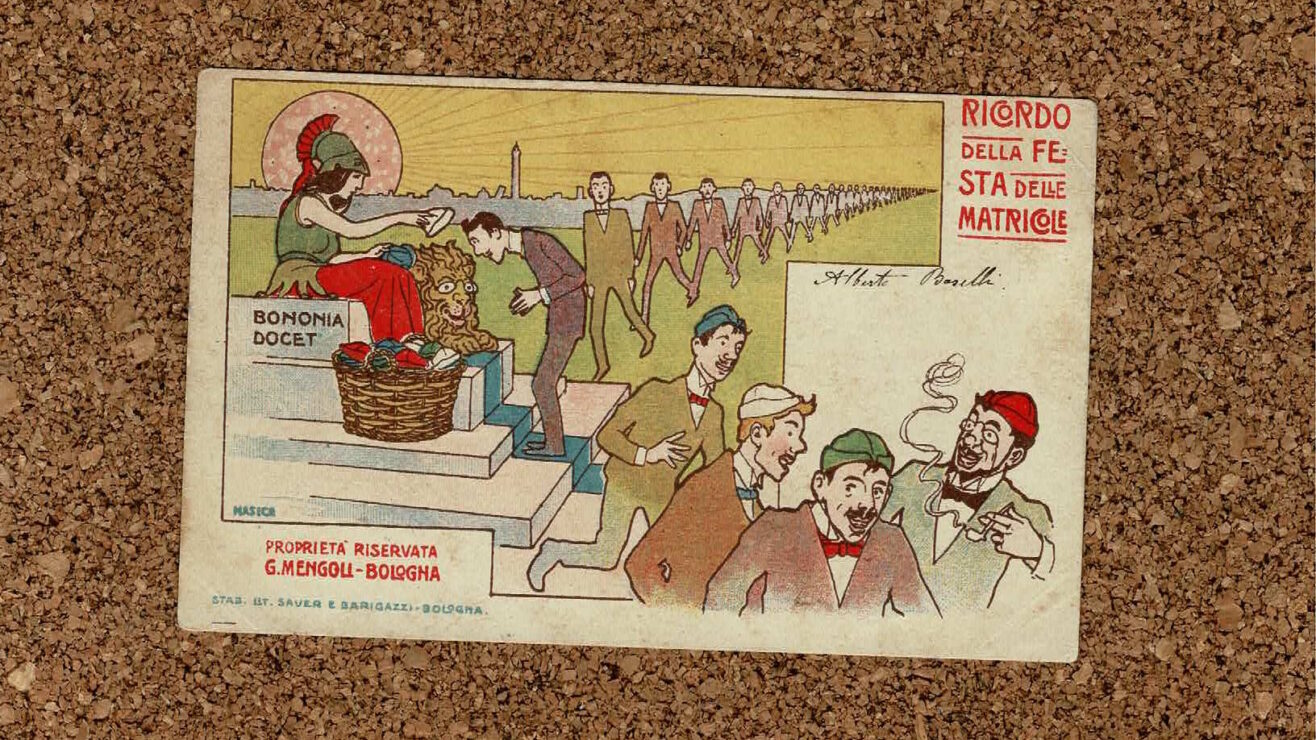

Here’s a visualisation of the provider-level £3,000 fee refund for all full-time, OfS-fundable, undergraduate students (as of last year – the bulk of students in England), compared with staff costs at the provider. Outside of the Russell Group and a handful of other research intensive universities, this would put a serious dent in the ability of a provider to pay people.

It is possible to argue that universities could find money from other sources – selling buildings during a lockdown and in the face of a global pivot to remote working, for example. This is a bad moment to liquidate that kind of asset, and leaves the provider high and dry when on campus study fully returns and space is needed for teaching. And as we’ve been over on Wonkhe before, there’s not a lot else that can be cut.

Rent

Similar arguments apply to accommodation providers – though costs may actually fall in the short term for some (less residents means less maintenance, less catering and less cleaning) but most rental income is used to pay back loans used to buy or develop the property. The margins are eye-wateringly high for some, but any across the board reduction would drive some accommodation providers – most likely the smaller, buy to let house for multiple occupancy end of the market – out of business.

This has both a short term and long term impact – less places for students to live, and an overheated market meaning students pay more for lower quality housing. In future years, given demographic growth, we will need those bedrooms to put new students in. Some will return when full on campus study does – others will pivot or sell up in the face of short term pressures. Few, I imagine, will be shedding tears over the plight of student landlords (frankly, I still think I should have got my full maintenance deposit back in 1998) but we do need to think more strategically about capacity.

According to the UCAS/Knight Frank survey for 2021 last year the average student paid £7,200 for a room in a private hall, £6,650 for a room in a university hall, or £5,900 in a privately rented house share. In a normal, non-plague, year 84 per cent of students surveyed felt these costs were affordable or just about affordable. Nearly half of students had financial support for parents or guardians – and only 32 per cent reported that the maintenance loan covered all their rent and living costs. Forty-six per cent of students worked part time in order to cover the cost of accomodation.

According to HESA data, first year full-time students are overwhelmingly living in provider maintained property – those in other years tend to be in “other rented accommodation”, primarily private rented houses in multiple occupation. This varies by provider and by region – but first year undergraduates in halls is a constant. Throughout the pandemic there has been a kind of national assumption that all students are first years – and it is first years again who would be the likely beneficiaries of fee refunds.

Maintenance

In policy terms the easiest, cheapest intervention – with the most immediate impact – would be to enhance in-year support for students. This could also be used to support academic interventions – for instance an extended academic year or supplementary teaching – which would mean that degree courses could be completed. Students would immediately feel a benefit – money in the pocket – and this would also have a positive impact on anxiety.

Though rent refunds and reductions are likely to be widespread they will not be universal, so some of this money would end up in the pockets of landlords. The only way to mitigate this would be to return to the repayment holiday idea from the spring and summer of last year – if the smaller buy-to-let landlords have no outgoings this would make it easier to reduce or remove rent, and this would in turn put pressure on larger concerns.

In England the top whack for most students is currently £9,203 (£12,010 in London) – but by mousing over the bars in the graph above you can see what an average student may get in each provider. Means testing means that the average student gets about £6,500 at Manchester Met (round about the Approved (Fee Cap) average, and about £5,800 in Manchester.

Giving the 979,671 full-time, loan eligible, students at Approved (Fee Cap) providers an additional payment of £3,000 would cost government £2,939m – a not insignificant sum in itself, but substantially cheaper and potentially less disruptive than a fee refund.

So what should be done?

As I think the above makes clear – for me the simplest and most effective means of compensating students is to put money directly into their pockets. This can be used by students to meet immediate needs, and gives government an immediate good headline. If the price feels steep we could look at means testing (via the same metric as existing maintenance loans), or expanding loan eligibility rather than providing grants.

The alternatives are more complex – there is no simple way to refund or reduce rent for all students. Putting pressure on the landlords that are more likely to do the right thing (providers, private halls) means you are compensating some students and not others based on where they happen to live rather than what they need. A bailout for by-to-let landlords would not necessarily reduce rent, and would not play well with the public.

Though I’ve focused on the majority student population here – we need also to think about the plight of part-time students where intensive periods of in person study may have been lost entirely, overseas students paying substantially higher fees, and postgraduate students who are on shorter courses and may well have funded themselves.

On the face of it – fee refunds do make sense. But there are a lot of complexities. Many providers would need an immediate bail out, something the government has set its face against. The benefit would not be felt by current students, but by the best paid of future graduates – it would be a regressive measure. And expecting providers to take the hit worsens the student experience.

Great summary – any financial refund by an HEI to one group of students, by definition, hits many others whether now or in the near future. The only practical option is government funded directed support to students.