A stealthy change in student loan terms will have huge impacts

Jim is an Associate Editor (SUs) at Wonkhe

Tags

Buried in the bowels of the DfE doc, it was brought to my attention by a correspondent on Twitter as follows:

It’s also worth noting the subtle change in uprating from using average earnings to index the threshold to using RPI (as is done with the Plan 1 threshold). RPI is being aligned with CPI so all studebt loans in future (including Plan 2) will have circa 2%pa rises, rather than 4%

— Brian (@brianharrisonuk) February 25, 2022

Basically for new borrowers you’ll recall that the government announced a £25,000 repayment threshold to apply up to April 2027. Given where inflation and wage growth are right now, that’s already a figure that’s likely to feel much smaller by then.

But beyond 2027, DfE also snuck in a cheeky little change as follows:

The repayment threshold will be uprated annually from FY2027-28 onwards in-line with RPI, so that repayment demands on students do not increase in real terms year-on-year.

That’s one way of putting it. Another would be to admit that uprating by inflation rather than wage growth saves the government money and loads (even) more of the costs onto graduates, because we normally expect wage growth to exceed price rises so that people see a real improvement in their standard of living.

You’ll recall that for current (Plan 2) borrowers, the threshold was stealthily frozen by Michelle Donelan a few weeks back. And when that unfreezes, guess what:

From April 2025, the repayment threshold for Plan 2 loans will increase annually by RPI, rather than average earnings growth. This will align the uprating mechanism for the Plan 2 and pre-2012 (Plan 1) repayment thresholds, and further help to reinforce the sustainability of the HE funding system for future years.

The interesting questions that then arise are the impact for the Treasury and the impact for borrowers. Now IFS have spotted the changes and have crunched the numbers – and they’re really quite extraordinary.

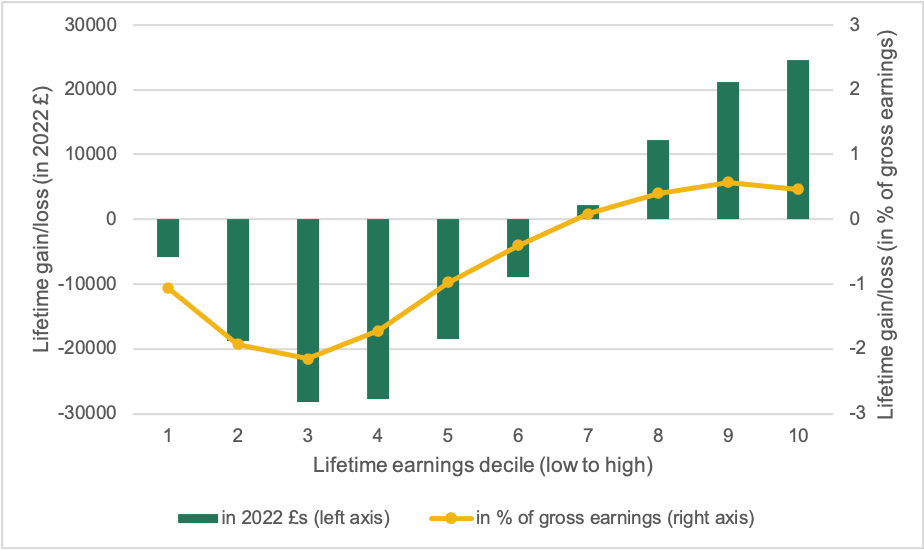

They find that graduates in the third and fourth earnings decile will be paying £28,000 more towards their student loan over their lifetime, rather than £15,000 and £19,000 as they said originally. That’s partly because of changes being made to how RPI is calculated – but IFS points out that according to OBR forecasts, from 2030 the repayment threshold will rise by 1.7 percentage points less every year than it otherwise would have done.

Naturally, that means big savings for the Treasury. IFS reckons the net long-run saving on loans will be £2.3 billion per cohort rather than £1 billion (undiscounted RPI real terms).

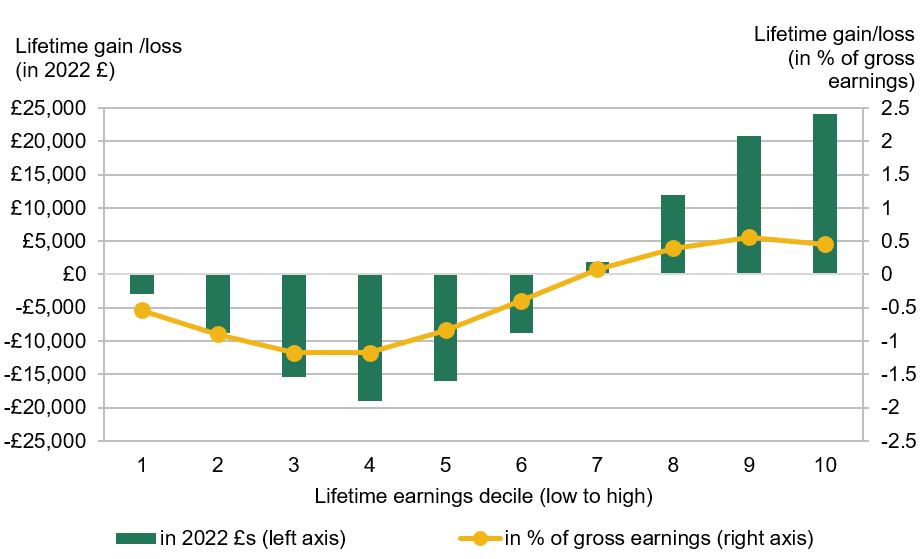

And to see how that plays out for graduates earning different amounts, check out the differences between these two graphs – the second reflecting the change:

As we’ve noted before, “fairness” in the package is sold as a reduction in interest rates (that sounds good), reducing fees in real terms (that also sounds good), giving graduates longer to pay back their loan (30 to 40 year term), but asking graduates to pay back more of their loan generally to ensure the system is sustainable (that also sounds good).

The problem is that that actually means massively reducing the contribution made by rich (usually male) graduates and hiking up the costs for middle to lower earners to pay for it. That all looked bad enough last week – it now looks even worse.

We also don’t yet know what the impact will be on loan take up. Augar was worried that more students who don’t need a loan would take one out if the interest was only RPI. We might assume that those kinds of borrowers will mainly pay it back in full. But it won’t make the overall debt figure on the books look any prettier.

The aligning of RPI with CPIH aside, it does significantly alter the argument that has been made for years that the government’s use of RPI rather than CPI in student loans (e.g. to set interest rates) is bad for students. As someone who is affected by the Plan 1 threshold which has been uprated by RPI since 2012, this has been a source of frustration for me. So I am pleased that consistency has won out and all thresholds will be uprated by the same figure (this is equitable). Labour made the same switch in 2005 from earnings to RPI… Read more »