Wales will make student loans more regressive too – just a bit later on

Jim is an Associate Editor (SUs) at Wonkhe

Tags

On the topline, Miles has announced that unlike in England, next year Wales will continue under the current graduate repayment system for a further year. That means that new borrowers will continue to use the £27,295 repayment threshold rather than the new £25,000 Plan 5 threshold, and graduates in Wales will repay loans under the 30-year repayment period, not Plan 5’s miserable (and regressive) 40 year repayment period.

Noting that earlier this year the UK government announced its long-awaited response to the Review of Post-18 Education and Funding, he reminds us what he calls here ”Plan 5” (which we think is the first time next year’s English student loan terms have been described with that label) is designed to reduce the Resource Accounting Budget (RAB) charge – the annual estimate of the proportion of the student loan book that will not be repaid.

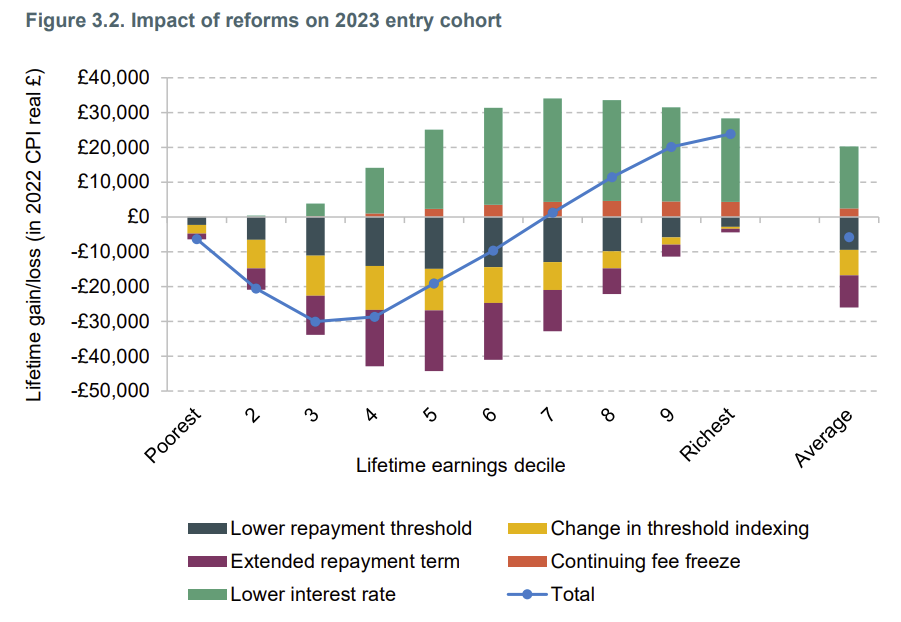

To reduce the subsidy, he also reminds us that the new system draws into scope more individuals – in the main middle-lower income groups of graduates – who either currently do not pay or pay a relatively small proportion of their loans – which makes it more regressive for more graduates than the current system. IfS has a picture that illustrates as follows.

Sadly for Miles, while Wales has significant in-principle autonomy over student finance, in practice aspects of the scheme are almost impossible to disentangle from England – the interest rate, for example. But there’s another problem – if the Treasury is saving money, you’d have to assume that has consequential impacts on devolved nations – which the rest of the Welsh government will doubtless be keen to ringfence into higher education.

To handle that you’d want maximum notice and information from the Treasury – but no such luck. He says here that it is “hugely frustrating” that Wales was given little warning of the changes before they were announced, that the Treasury took an “extremely long time” to communicate the budgetary position, and that he’s been asked to make a decision in an “unreasonably short timescale” with “insufficient information” on the impact on Wales’ future graduates.

So while the headline news is surprisingly attractive, doom is coming. That one year moratorium on changes to terms will need to change eventually – partly because of “the systemic alignment of our repayment systems”, and partly because he’s “working within the financial constraints set by UK Treasury”. The upshot? Wales will need to “move to Plan 5 in 2024”, and he’ll use the time he’s bought to work out how to deliver a little Wales sweetener or two to make the package comparatively, but not actually, more progressive.

As it stands Wales still has the “most progressive” student finance system in the UK by providing means tested grants as part of the package – which means that Welsh students incur significantly less debt than students in England. The Welsh RAB charge is lower than in England because students build up less debt.

But the mild stingy reminder right at the bottom is how hard it sometimes is to get across that more “debt” can be progressive depending on the other terms like write off and repayment threshold. Next year’s borrowers in Wales will be charged interest at RPI up to RPI+3% – in contrast with English borrowers who will only experience interest rates at RPI – a decision (as we’ve noted before) that feels progressive but is actually highly regressive.

While we have had 30 years of notional devolution of HE funding since the reforms of 1992, the current reality is that the Barnett formula means that decisions taken for England have a very significant effect on the amounts available for the elected devolved governments to make their own decisions about HE.

That is currently the significant consequence of the alterations in the RAB charges on the Department of Education in England due to recent changes in the rules for student fee loans. That fiscal consequence is significantly different from arrangements in federal states (where all the constituent states are affected equally by decisions of the central government). There’s not the slightest chance of fiscal federalism emerging across the UK state, as the UK government (and the official opposition) continues its hard Brexit/muscular unionism approach – England is the problem.

So, the reality is rapidly becoming clear that only independence from the UK state offers devolved governments the opportunity to break HE free of the fiscal straitjacket of following whatever is implemented for England within their own democratically elected jurisdictions. In Scotland that takes the form of the demand for an independence referendum, endorsed by the election result in May 2021, while in Wales it currently takes the form of demanding ‘Home Rule’, or ‘DevoMax’ as it is called by Welsh Labour though independence is not far behind in popular support, and in the north of Ireland the majority are clearly heading for an all-Ireland/post partition economic solution within the EU.

The future of HE funding is only one significant cog in the wheel of state governance reform – but it is quite a significant cog.

Of course – but Wales doesn’t have to ring-fence all of the negative Barnett consequential of English HE reform to its own HE budgets.