The poorest students are being fiddled out of £2,000 this autumn

Jim is an Associate Editor (SUs) at Wonkhe

Tags

- The first is that the household earnings threshold under which students are entitled to the full loan has been fixed since 2007 – causing more and more families to be entitled to less and less each year.

- The second is that the inflation rate that is applied tends to be a snapshot picked many months in advance – and means that if inflation rockets up in the meantime, that September’s increase is inadequate.

- The third is that when that happens, the problem is never fixed – and so 2 or 3 years in a row of under-prediction has a negative compound impact on the value of the loan.

As we’ve noted here before, in the current year the (away from home, outside London) rate is already £492 short thanks to this problem – and we thought that it would end up £1,154 short this coming September.

But that was based on March 2022 OBR projections for RPIX (RPI without mortgage payments) of inflation at 9.2 percent, versus the DfE prediction figure of 2.3 percent. This morning the National Institute of Economic and Social Research (NIESR) predicts that RPI will hit 17.7 percent in Q4 this year.

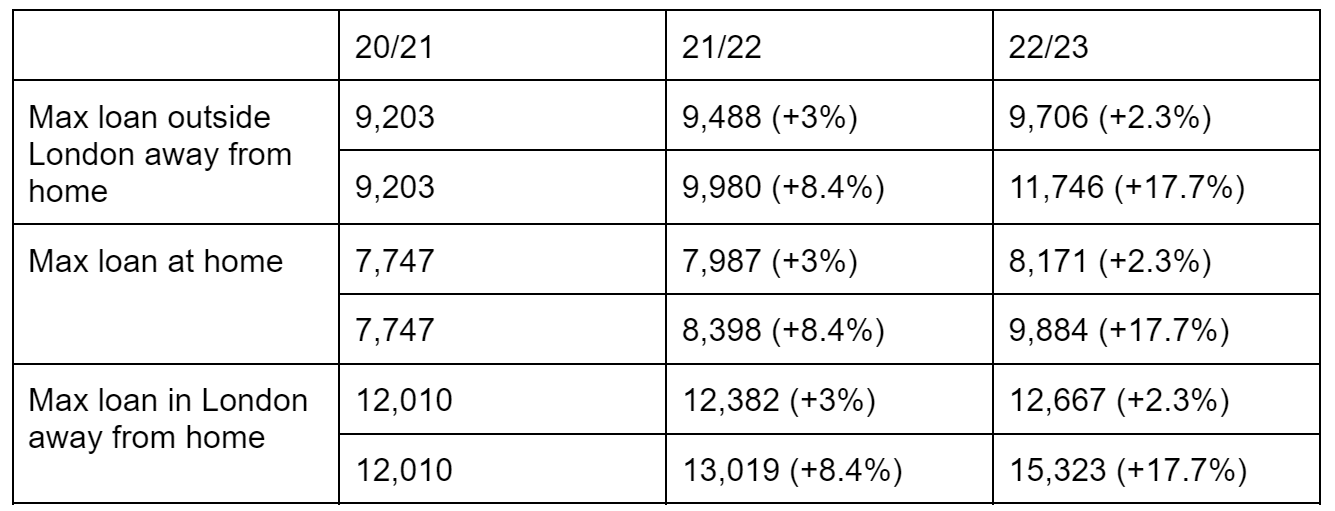

RPIX may well be even higher than RPI – but if it was at 17.7 percent, that would enlarge the forecast inflation error significantly – leaving students on the maximum maintenance loan £2,040 worse off than they should be. The figure is £2,656 for students away from home in London, and £1,713 for those at home:

And remember – to deal with Problem #1 above, we would also need to add at least £1,000 to those figures.

The nations have similar problems (I have no idea how on earth any NI domiciled student on a low income will live if they’re studying in London, for example), the figures above apply to Disabled Students Allowances in England too, and this should also remind us how spectacularly inadequate the home office’s living costs estimate for international students is (it has applied a less than 1 percent uplift to the amount required to be held in the bank on entry).

There’s no sign of anything coming from DfE, most bursary and scholarship packages aren’t being uprated for inflation at all, most universities seem to be applying inflationary increases to halls prices and both PG and international fees, and let alone the poorest – the chances of large swathes of the lower middle classes being able to parental-contribute what they were last year are zilch.

Things really are going to get very grim, very quickly. The contrast between the level of planning effort, public lobbying and observable detail to keep the show on the road in 2020 and now is astonishing, really.

There is, just as an aside, an interesting little quandary coming for DfE. Usually by roughly now we have the figures for the 2023/24 uplift. But if, as is usual, it applies the Q1 2024 prediction from last March, it’ll only uplift loans for 2023/24 by 1.8 percent. Surely to god it won’t get away with that?