Student rents in Edinburgh fall to £200 a month, and the price of a pint in London halves. Apparently.

Jim is an Associate Editor (SUs) at Wonkhe

Tags

The cause of my apoplexy today is this year’s iteration of the NatWest “Student Living Index” – which last year attempted to argue that the average cost of a pint in London for students had risen to £9.10, and nobody in the office had thought to check the conclusion for sense before hitting send on the press release.

This year we are expected to believe that “average student incomes” have increased by 65 percent this year, while “average student costs” are 29 percent higher than last year.

Underpinning these findings are nuggets like “Average student monthly rents have fallen 12 percent this year” (which the report puts down to “the increased popularity of university accommodation”), “Coventry shoots to the top of the list for [student] income” and “Canterbury is the university most likely to be chosen for subject choice”, although the summary fails to mention whether “Canterbury” means the University of Kent, Canterbury Christ Church, the University for the Creative Arts or East Kent College. Or all of them.

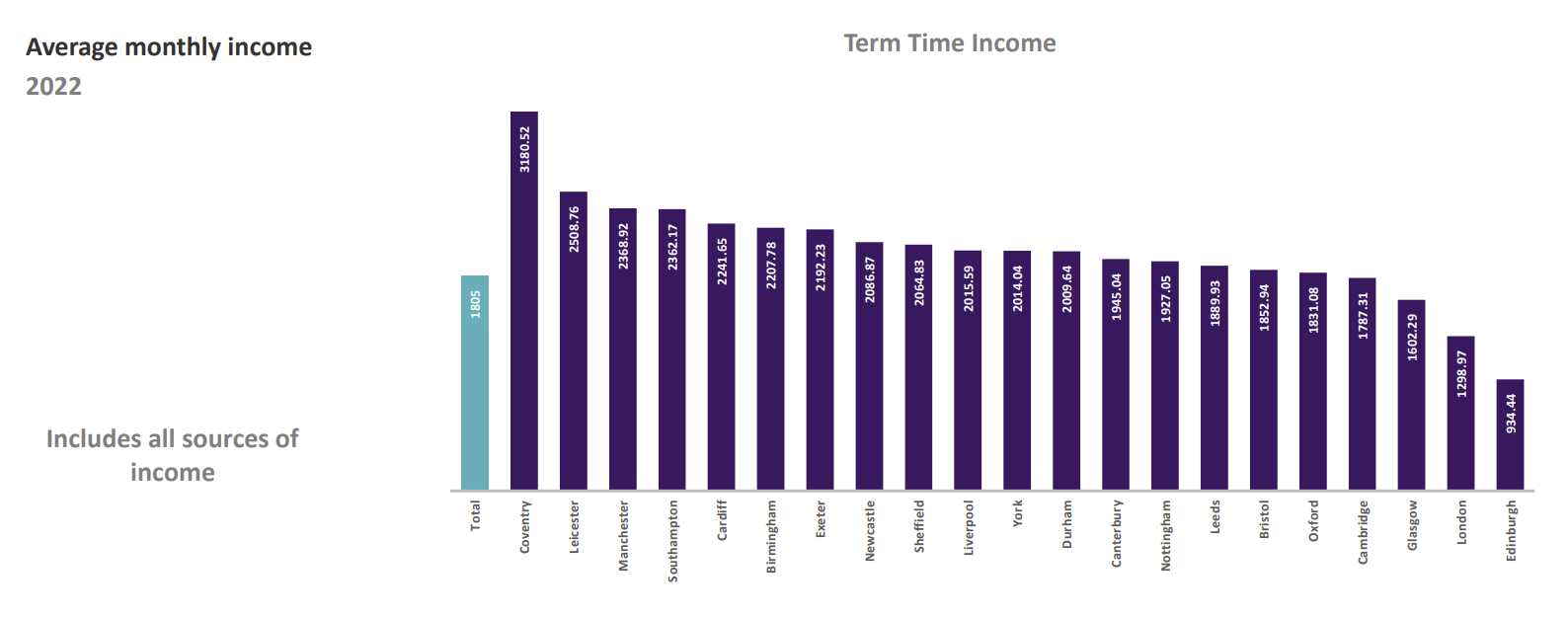

The first big chart that pops up is one that attempts to argue to us that London has lost its place at the top of the charts for NatWest’s “Student Living Index”, which it calculates by taking average monthly living and accommodation costs and then divides by the average monthly income. It’s a finding that is partly explained by a chart that says that students in Edinburgh have a term-time total income of £934 (down from £1,037 last year) while those in Coventry have an income of £3,180 (up in one year from £1,107).

It’s also partly about costs – on the rents chart we are told that average monthly student rent in London has fallen by more than £100 in a year, while also expecting us to believe that average monthly rents in Edinburgh – which is facing extreme student housing supply constriction – are now just £200 a month. Great news for students in Cambridge too – apparently rents have fallen from £579 a month to just £225 a month. Big congrats to Cambridge SU.

Last year the survey told lazy editors that students “at Oxford and Cambridge are those most likely to spend more time studying on campus” without telling those editors that its figures included students at Brookes and ARU. This year we are expected to believe that Coventry students have halved their spend on groceries YoY, and students in Cambridge have seen a reduction in the price of a pint from £8.20 to £3.60.

One page tells us that Leeds is now top for “I put it as my first choice for reputation reasons” without telling us whether the 100 respondents are at Uni of, Beckett, Trinity, the University of Law, the Global Banking School or some other provider. And I don’t know what they’ve put in the water in Edinburgh, but apparently this year only 7 percent of students find their degree stressful in the Scottish capital – down from 25 percent last year.

And when it comes to financial support from their university, we learn that 56 percent of Durham students got nothing while just 9 percent got nothing in Coventry. We’re not invited to reflect on the proportions that might actually need the support or the amounts they’re getting when they do. Probably just as well.

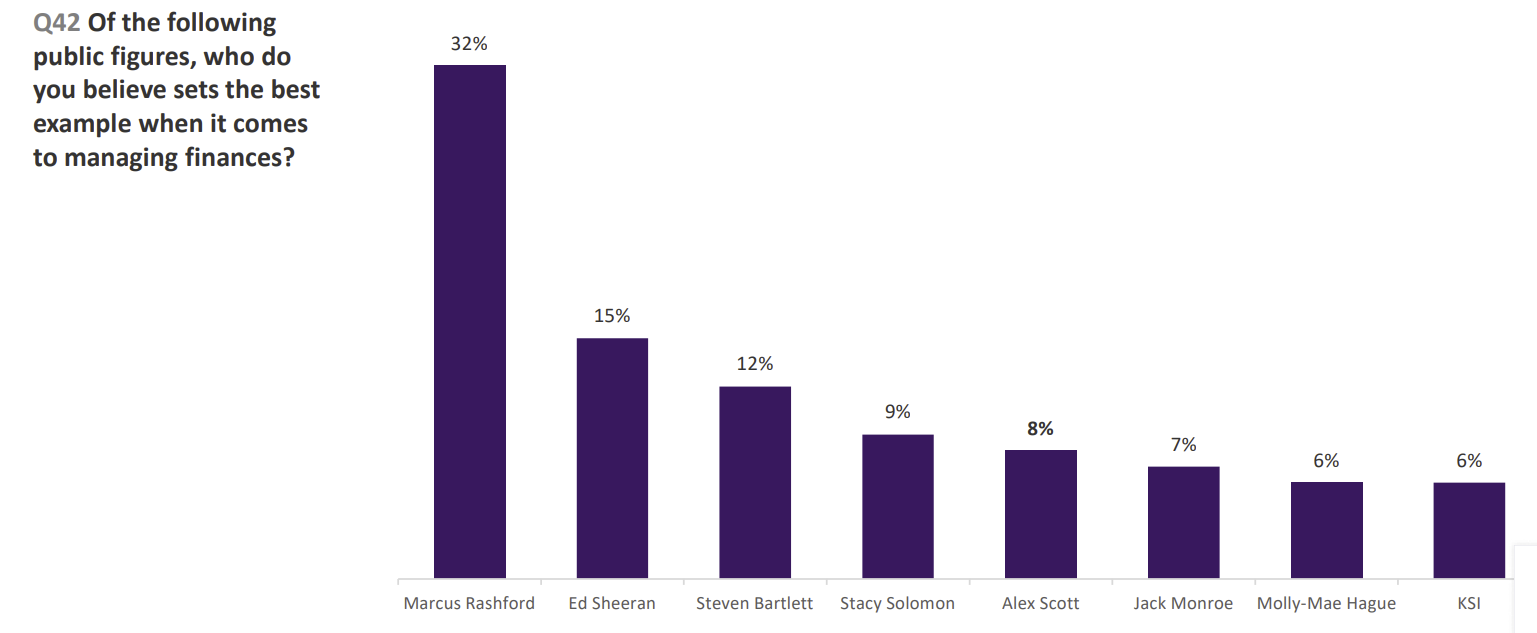

Another page tells us that Nottingham and York students top the list of those planning to move back in with their parents/guardians after university, even though the graph below it has Coventry as top and Durham as second. And it also helpfully tells us that 32 percent of students think Marcus Rashford (annual salary excluding sponsorship deals of £10,400,000) “sets a good example” when it comes to managing his finances.

The problem with all of this astonishing drivel – from an actual major high street bank that purports to be interested in students doing good budgeting and making good choices – is that applicants might end up making actual choices about where to study off the back of it. Worse, they might end up doing budgeting off the back of it. Seriously, if I find a university quoting any of this for their cost of living pages, I cannot commit to being responsible for my actions.

I’m not suggesting that the findings are made up (although they may as well be) – but the conflation of provider with city, the failure to weight the sample, the failure to control for influencing factors and the failure to weight YOY comparisons by the sample sizes from each provider and city makes the findings roughly as useful as university cost of living information pages, this student pints price index, or the old Bocca Della Verita machine at Scratchwood services.

Providing accurate CoL information, (where each element is verifuable and auditable), for every university including all course costs should be a statutory requirement completed by an independent agency (ie not universities) perhaps by the OfS

I don’t see what the problem is. Clearly getting a job with an income of £10.4m is a very good way to manage your finances.

If every student would only follow Rashford’s example there would be a lot less whining about student loans!