Non-continuation in some franchised partnerships is unacceptably high

Jim is an Associate Editor (SUs) at Wonkhe

Tags

It shows data for a small number of providers involved in large partnership arrangements – the sort we’ve talked about at length on the site, which often involve private providers not on the OfS register delivering (in the main) Business and Management, and Health course, often with a franchise year, often sold via domestic agents, and which seem to have enjoyed very rapid growth in recent years.

We’ve got data from six “lead” providers who are subcontracting out to seventeen “delivery” partners, and it contains both information on student outcome measures (the standard continuation, completion and progression stuff) and reports an overall indicator and academic year split indicators.

It’s not clear whether a particular size or threshold was used to select the six lead providers, and it also looks like not all of the franchising that each of those six providers have been doing is covered – Leeds Trinity’s arrangement with the Applied Business Academy doesn’t show up here, for example. But where provider A franchises to provider B, that is a partnership with some outcomes data, and we do have a selection to look at.

What we do know is that all six lead providers (Anglia Ruskin, Bath Spa, Buckinghamshire New, Canterbury Christ Church, Leeds Trinity and Suffolk) appear in the top right hand corner of the chart showing providers where the number of maintenance loans and total maintenance loan value both outstrip their fees equivalent.

There are other issues with the snapshot, other than how lagged the data is that is used to assess outcomes. All of the usual data suppression rules apply to each of these partnerships, and so there’s lots that we can’t see – but that maybe would make sense if they were aggregated together by the “delivery” partner.

More generally on that, if one of the things you are interested in as a member of the public, a policy maker, a prospective student or even a podcast host is the aggregate performance of one of these for-profit providers, we don’t get those views unless those providers are on the register.

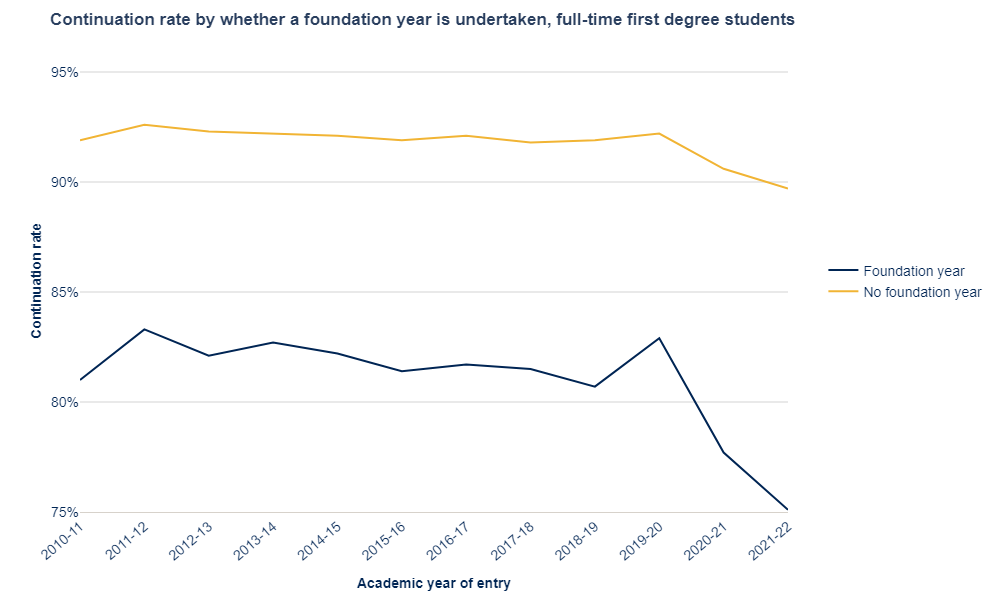

We’re also still in that strange position where the continuation metric applies to whichever year a student starts on – so we have those starting on UG year one mixed in with a foundation year. On one level, nothing wrong with that – but it’s important that we at some stage get to assess the performance of franchised foundation years for all the reasons we’ve discussed before.

Some of the above is promised for a later date – to include more of this sort, plus transnational education and partnerships where the provider validates courses delivered by other providers in England. But what we can do is draw some conclusions about the partnerships we can see in this release. From a threshold point of view, it’s not pretty.

Below threshold

If we just take Full-Time, First Degree undergraduates, the numbers in scope here have gone from 4,840 in year one (2018 entrants) across six partners to 28,800 in year four (2021 entrants) across 19 such partnerships.

In year one, only two of those six partnerships had a continuation score of less than OfS’ 80 per cent threshold – Anglia Ruskin’s partnership with Cambridge Ruskin International College on 78.4 per cent, and the University of Suffolk’s partnership with St. Piran’s School (GB) Limited (which trades as the London School of Commerce) on 70.5 per cent.

Roll forward to the most year for which data is available, and there are 19 partnerships – and of them, only two hit the continuation minimum required.

One is the University of Suffolk’s partnership with the Global Banking School Limited on 81 per cent, and the other is Buckinghamshire New University’s partnership with Mont Rose College of Management and Sciences on 86.4 per cent.

| Lead provider | Delivery partner | Continuation |

|---|---|---|

| Anglia Ruskin University Higher Education Corporation | Cambridge Ruskin International College Limited | 69.3 |

| Bath Spa University | Elizabeth School of London Limited | 76.9 |

| Bath Spa University | Fairfield School of Business Ltd | 78.3 |

| Bath Spa University | Global Banking School Limited | 77.1 |

| Canterbury Christ Church University | Global Banking School Limited | 78.5 |

| Leeds Trinity University | Global Banking School Limited | 66.7 |

| University of Suffolk | Global Banking School Limited | 81 |

| Anglia Ruskin University Higher Education Corporation | LCA London Limited | 66.8 |

| University of Suffolk | LD Training Limited | 68.7 |

| Leeds Trinity University | LD Training Services Limited | 68.3 |

| Buckinghamshire New University | London School of Commerce & IT Limited | 68.6 |

| Buckinghamshire New University | London School of Science & Technology Limited | 76.5 |

| Buckinghamshire New University | Mont Rose College of Management and Sciences Limited | 86.4 |

| Buckinghamshire New University | Oxford Business College UK Limited | 78.7 |

| Buckinghamshire New University | RTC Education Ltd | 74.6 |

| Canterbury Christ Church University | St. Piran's School (GB) Limited | 75.6 |

| University of Suffolk | St. Piran's School (GB) Limited | 72 |

| Leeds Trinity University | UK Curriculum and Accreditation Body (UKCAB) | 73.7 |

| Leeds Trinity University | Waltham International College Limited | 73.9 |

If we aggregate the performance of the franchised-to providers in this sample, albeit the percentages are not at full resolution so it’s indicative at best – the other partnerships with GBS bring its aggregate performance down to 78 per cent, leaving just Mont Rose over the required 80 per cent.

To the extent to which you agree with OfS’ logic over that threshold partially representing a minimum level of quality, the vast majority of the partnerships we’ve been shown today do not hit the required level of quality.

The data necessarily gets patchier for completion and progression – they are things that take longer to measure, but being “below benchmark” on all three metrics for all four years can be seen liberally sprinkled across the partnerships and qualification types covered.

Questions to be answered

We can’t draw real conclusions from the data for all the reasons outlined. But what can see raises really serious questions about OfS’ regulatory approach, the “value for money” that students are getting across these providers, and the kinds of profits that this group of franchised-to providers are making – detailed on Mike Ratcliffe’s blog here.

Not all of the profit will be generated from this group of students, and often the financial years don’t match up to academic years – but (bearing in mind most of these are not in the register so the level of accounts transparency is restricted in comparison to those on it), pretty much all of them have grown their turnover since 2021/22 and much of that turnover comes from fee income.

Where the franchising is happening, the franchising provider will have topsliced some of the fee income (the rate of which there is no transparency over) too. The accounts of these providers also reveal often large dividends to directors, and agents will have been making money too out of the supply of students into each of these partnerships.

It’s also worth bearing in mind that access and participation performance includes these franchised courses and students – which depending on your view, enables a provider to reach students it wasn’t otherwise reaching, or enables a way of cheating the system by making a provider look and sound like it has widened when it has in fact bolted on some business students with poor outcomes in another city.

You might be thinking that OfS should maybe have included some characteristics data about the students in question – it hasn’t quite, but there is a “size and shape” release for students currently at providers in the sample showing everything from subject of study to sexual orientation via most of your usual access measures. It’s not for the same years as the students in question, but we can’t have everything. DK has a dashboard for you if you think this might help.

In a blog accompanying the release, OfS’ Head of Student Outcomes Graeme Rosenberg says that there’s a downward trend forming for full-time students continuing in their first degree, and that the regulator has identified four overlapping areas with more significant decreases – students studying with an integrated foundation year, students studying in a subcontractual partnership, students on business and management courses and students with lower or non A-level entry qualifications.

It’s reassuring to hear that OfS has finally noticed what we’ve been banging on about for some time now – perhaps less reassuring that this is the first time that it’s said so, and doesn’t appear to be accompanied by any reflection on the huge profits being made, how those courses are being sold, what may or may not be going on with student loans or what OfS might be planning to do on franchising fees transparency.

Us mere mortals can’t see most of the data yet, but let’s hope it’s sharing all of this with the Department for Education. Its data release on outcomes back in October 2023 failed make the distinction between FYs in franchises and FYs in general, and that underpinned its decision to cut fees for classroom subjects – quite the baby out with the bathwater, that.

We do still need much more data here – the questions about this type of provision are big, varied and unanswered by providers or OfS. But on the evidence so far on the metrics and thresholds that OfS uses, a rapidly growing group of the very students who deserve the most protection are being failed.

It is amazing to see the number of new entrants for some providers….CCCU/GBS from 1200 to 5500 entants in 1 year. CCCU all published subcontract new entrants only 2020 = 2340. In 2021 = 9460. Planned growth?