Government maintenance loan policy will have a “negative impact” on students, says government

David Kernohan is Deputy Editor of Wonkhe

Tags

Students will experience significant disadvantage due to the decision not to uprate maximum maintenance loan amounts to compensate for three years of higher than expected inflation.

Not our words, or a well-meaning report from a think-tank or sector body. The position expressed by a publication of His Majesty’s Government.

If only they knew someone who could do something about it.

Second prize

What we have is an equality analysis for the Education (Student Fees, Awards and Support) (Amendment) Regulations 2023. This one addresses the point – or, as we will see, attempts to address the point – that raising maximum maintenance loans by just 2.8 per cent this year is detrimental to all students. We start with some fundamentals on student finance:

“Government intervention is needed because a private sector led credit market for student finance would not work: students would not be able to borrow, partially or fully, the money they need to cover the costs they incur during study and repay the lender once they have graduated and started earning an income

Why? Well, students can’t be sold into slavery, basically.

“students are unlikely to have collateral which they can offer lenders as security (human capital not being a physical asset) or sufficient liquidity to service loan repayments. Moreover, lenders do not have perfect information about the credit worthiness of students and their ability to repay the loan

So the government should step in, and not only that it should increase “the maximum level of student support available across these different streams of funding in line with forecast inflation” to ensure that the quantity of goods and services students are able to buy with their support loans remains the same.

Outturn figures

Back earlier this year these decisions were made based on the forecast (RPIX) rate of inflation for the first quarter of 2024, which was 2.8 per cent. That this was not a sensible forecast should have been apparent even in 2022:

- The outturn RPIX for the first quarter of 2022 was 8.5 per cent, compared to the 3.1 per cent forecast used to uprate support for that year.

- And at that point the forecast RPIX for the first quarter of 2023 was 12.1 per cent, compared to the 2.3 per cent forecast used to uprate support for that year.

So if we are sticking with RPIX as a measure of inflation, compensating for different between forecast and actual rates for those two years while still sticking to the 2024 forecast of 2.8 per cent would mean this year should receive an increase of 18.5 per cent (if you used 2020-21 as a baseline and CPI this would still be a hefty 13.7 per cent uplift). Without this we get (via a citation to the IFS report) to a situation where:

“many students, including from groups who share protected characteristics and from disadvantaged groups, will not be able to make the same spending decisions as they did previously with regards accommodation, travel, food, entertainment and course related items such as books and equipment, the costs of which will have been rising over time.

These equality analyses are meant to examine the impact of this decision on disadvantaged groups. But there’s almost no point. The effects are felt by all students – including those in disadvantaged groups.

Not equal

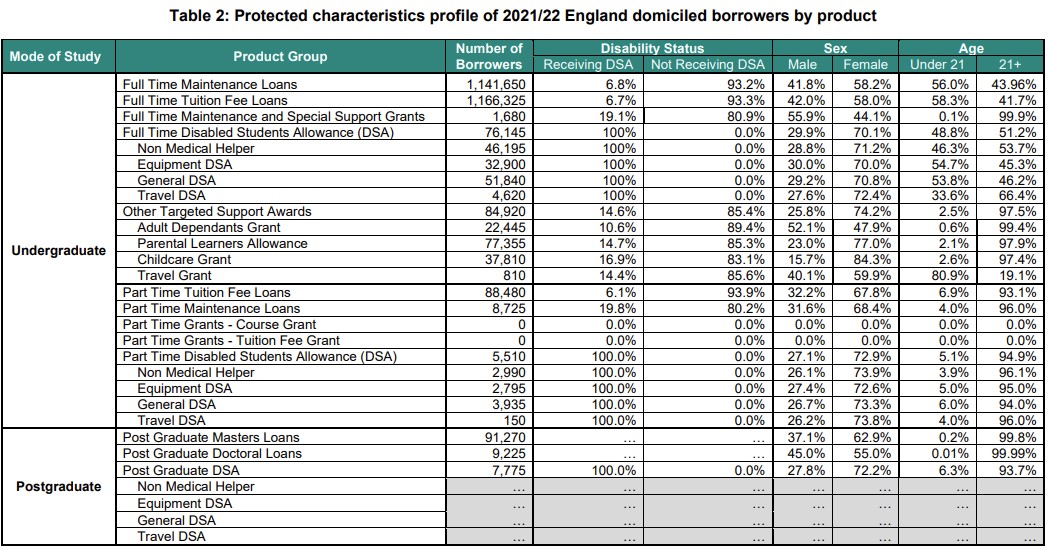

To the extent to which there is a point, the paper points out that impacts will be more significant on some students – because some are overrepresented in the loan borrowing population, and in the population receiving specific loan and grants products.

So here we are reminded that:

- Female borrowers form a larger proportion of loan borrowers and grant recipients so the impacts disproportionately hit them.

- Mature students (above 21 years old) are negatively because a higher proportion of older loan borrowers are part-time and postgraduate students. As students receiving support grants tend to be older than the full-time maintenance loan borrowers, and most grant recipients also receive loans for living cost support, they will be more adversely affected by the real-term loss in value of both grants and loans.

- Low-income groups of students will be adversely affected by the real term decrease in the value of the loan. In 2022/23, 63 per cent of English-domiciled students relied on loans or grants to pay for their living costs and 41 per cent of those receiving loans for living costs in 2021/22 had household income low enough to qualify for the full-loan amount.

- And students from minority ethnic backgrounds will be negatively impacted as they are over-represented across students in higher education. More are getting in – but when they get there we’re doing less to support them.

If you’re a university that tends towards the recruitment of women, mature students, low-income students and those from minority ethnic students, DfE is effectively saying that the pain is being targeted on you and your students.

What’s next

What I think we are now waiting for is the equality analysis for the Education (Student Loans) (Repayment) (Amendment) (No. 4) Regulations 2022.

That’s the one that deals with the deeply regressive changes to student loan repayment – meaning that everyone but the most well off graduates will end up repaying more money – over a longer term – than currently, while the richest graduates get a repayment reduction via an interest rate change.

It will have equality implications for days. Let’s hope we get to see it soon.

Surely the equalities analysis for the student loans repayment regs will just be the same as that published alongside the reforms on 24 February last year? They were bleak. Entirely went below the public radar. There was plenty going on at the time.