A summary of financial data and forecasts returned to the Office for Students in October 2020 by registered providers in England suggests that “the likelihood of multiple providers exiting the sector in a disorderly way due to financial failure is low.”

This, on the face of it, is great news. There was a lot of concern over the financial viability of providers over the summer, and although OfS notes that there is “significant variability” across the sector the official position is that the sector is in a sound position on aggregate. Data covers the 18-19, 19-20 and the start of 2020-21.

Wait… what?

The report is at odds with reports in the press suggesting that “sector finance experts” have been circulating a figure of 40 universities experiencing liquidity problems – issues turning assets into cash. To be clear, the sector finance experts we know aren’t quite so sure about this. A provider would be trying to do this if it had an unexpected income shortfall or an unexpected set of costs – and there was no evidence of that level of financial strain in October according to the OfS.

Data on finances was required from every provider on the OfS register other than further education colleges, who submit this information to the Education and Skills Funding Agency – back in November we spotted that nine FE colleges registered with OfS had received a “financial health notice to improve” from the ESFA. The equivalent HE end of this financial analysis should result in a Condition D specific ongoing condition – this has never happened.

Aggregations do cover a multitude of sins – an old and large diverse research intensive institution does not instinctively sit in the same bucket as a new small specialist provider offering a handful of courses in one subject. We do get some data that allows us to drill in to how different parts of the sector may be faring, but as usual with these summary analysis reports we are very much left wanting more. There will be a more detailed report at the usual point in the spring – this cut down version replaces what we would have seen in the spring had circumstances not rendered those forecasts largely useless.

Trends in aggregate

Overall, the sector is forecast to be down about £700m for 2021 – this over a strong under the circumstances (but below forecast) 2019-20 that ended up being broadly in line with 2018-19. The big hits this year are on overseas fee income, donations, and the “other” category that includes catering and conference (the latter £228m lower than last year).

These income estimates were made by providers around mid-October, so would not include any information on student retention problems this year leading to a drop in fee income – but would be based on the better than anticipated 2020 recruitment cycle. There are so many potential assumptions that may have been used to make these forecasts that they teeter on the brink of usefulness. But this is very much the best data we have.

From what we can see the sector has been using reductions in cash outflows – such as postponing or reprofiling capital spending – and efficiency savings to build up liquidity, which was stronger than was expected by the end of 2019-20 and makes for a resilient overall start to 2020-21. Providers will be spending this money this academic year – liquidity is projected to decline by over 16 per cent.

Borrowing is another source of resilience – having money now rather than later is incredibly useful in uncertain times. This is forecast to rise from £13.7bn to £14.2bn in the next year – and there’s £1.2bn out there in undrawn contingency borrowing (overdrafts, revolving credit) which could be used. A few providers are dipping in to this, but OfS claims that this “is a matter of choice rather than necessity to sustain their operations.”

Access to government borrowing (the Coronavirus Corporate Finance Fund, Coronavirus [Large] Business Interruption Loan Scheme, and Bounce Back loans) was a central plank of the bailout that wasn’t, over the summer. The majority of this support (some £1.24bn) remains undrawn, with providers using it as another source of contingency funds.

Sector variability

As usual, we don’t get anything on individual providers at this point – we never get forecasts, whereas other details will end up in HESA Open Data and provider financial statements. We do learn that there is a group of providers – a number in single figures – that OfS is monitoring more closely at this time. If you’re wondering about the 11 providers that the Institute for Fiscal Studies pointed to, I’d agree that there would very likely be a substantial overlap.

In terms of future performance, because the outlook is so variable – Covid-19, Brexit, recruitment and retention challenges, pensions valuation – it would have been very difficult to draw together a satisfying forecast for a provider. OfS does recognise this. The best we get is that the success (or otherwise) of mitigating actions in the short term will have implications for the longer term. Overall there will be a decline in fee income and funding body grants in 2020-21, but these will still be above 2018-19 amounts.

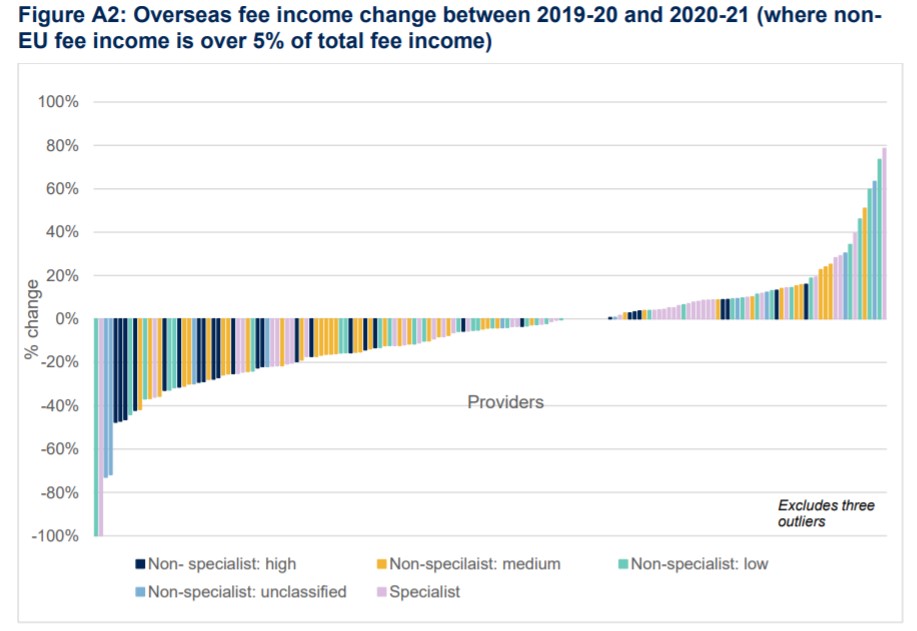

There are splits by tariff peer groups – high tariff providers are projected to drop five per cent as regards fee income next year, with the bulk of this being represented by a 12.6 per cent drop (-£457.8m) in overseas fees – even after the operation of the government’s SURE scheme that should make up some losses for research cross-subsidy purposes. One striking graph (A2) shows that two providers are looking at a 100 per cent drop in overseas fee income between last year and this year – and these are providers where overseas fees are more than five per cent of income!

Spending and sustainability

Providers are projected to spend 1.7 per cent more this year than last – continuing a pattern of growth that (USS adjustments notwithstanding) has persisted through the last three years. This is perhaps less growth than would have been otherwise expected (note the earlier comments on efficiency savings) but that it persists on aggregate is interesting given a small fall in income.

Cashflow from operating activities is forecast to decline by 59.2 per cent (to £1.2bn) between last year and this one. As OfS notes, this “measures a provider’s net cash generated from its operations to meet day-today obligations” – how much it has left over from income generated by core activities (like teaching and research) after paying salaries and other operating costs. Again the big proportional detriment is with high average tariff providers – down from around seven per cent of total income to just under one per cent – though the fall affects most larger providers. The falls in overall surpluses are lower, but still notable.

All this means – as noted above – a fall in the number of days of net liquidity (defined here as “the number of days from the financial year end for which a provider is able to pay its day-to-day expenses from the cash that it holds in its bank account and any short-term investments”). The drift down is more pronounced in high and medium tariff providers.

The figures on borrowing include an indication of the range of exposure within each tariff group – what stands out for me is that high tariff providers are edging towards borrowing up to half of their annual income, on average and as a median value. Part of this reflects the easy availability of finance to such providers, and a stable ten years as regards growth in enrolment and income. However, growth in borrowing is slowing overall.

So what does this tell us about the impact of Covid? There clearly was an impact last year, though it doesn’t look to be as devastating as it could have been. Providers have clearly made prudent decisions and drawn on additional support where needed. Next year’s figures (which we are getting earlier than might otherwise be expected – there’ll be a more detailed publication in the spring) are largely testament to the predictive abilities of sector planning and finance teams in very uncertain times – we should see this as indicative as confidence that, although things may get tough, the sector is in a good position (on aggregate) to weather the storm.

But those providers under close monitoring will remain a worry – there’s a lot of variables but it seems as if structural weaknesses remain. This next year will be less tolerant of these than any other time in recent history.