Universities worried that their recruitment numbers are shaky this year will be thrilled to learn that Martin “Money Saving Expert” Lewis has begun the process of reprofiling some demand from September ‘23 to this year by telling journalists that cancelling gap years could save students £40k.

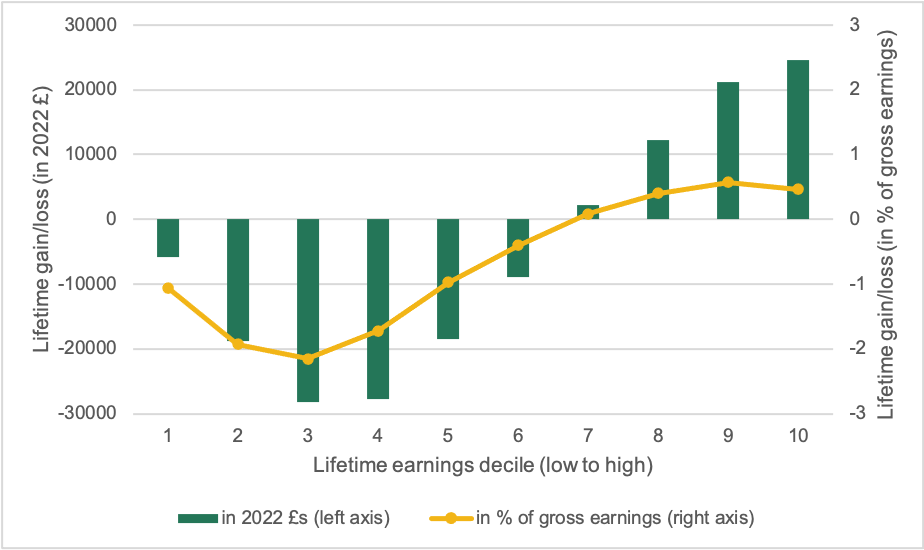

It’s not especially clear where he’s getting his numbers from – the IFS has the worst impact of the changes as just under £30k for those in earnings decile 3 – but it’s a reminder that the compound impact of the changes to student loans announced by further and higher education minister Michelle Donelan since the spending review also made the system much cheaper for those who will end up earning more.

It’s a particular irony that those from low-income backgrounds that need to work and save up some money to supplement an inadequate maintenance loan on a “gap year” will find it hardest to follow Lewis’ advice, while those aiming to find themselves and recreate a scene from a 1990s Comic Relief episode on a “gap yah” would be wise to ignore his advice altogether.

Martin Lewis should also stop and think for a minute about what a student numbers rush this autumn will mean for local rent costs. We already have tens of thousands of international PGT students living hundreds of miles away from most major university cities. Do we think a university fill-your-finance boots approach to September will make that better, or worse?

But when piecing together this puzzle, it has been galling enough to discover that making higher education more expensive for graduates in earnings decile 1-6 was in part helping to make it cheaper for those in deciles 7-10. What we now know is what the rest of the savings will be put to.

Where’s your headroom at

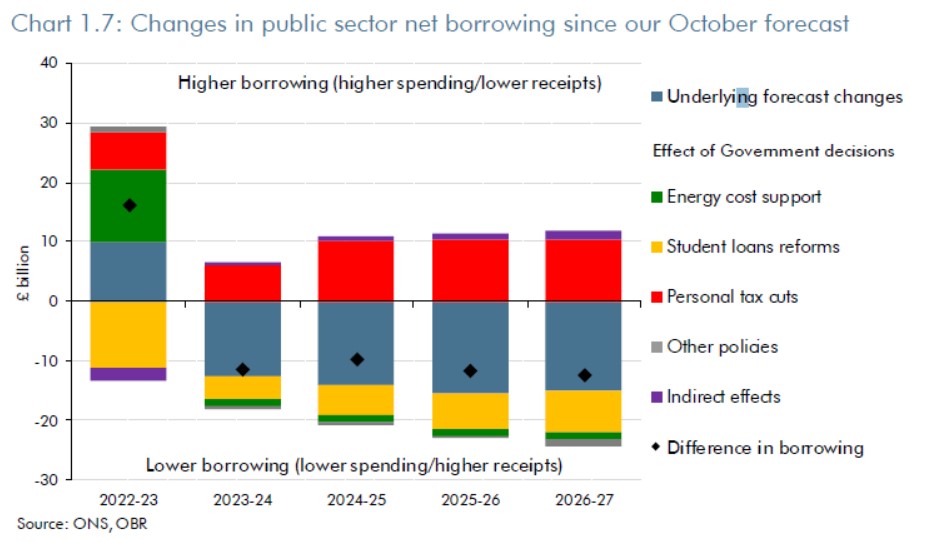

Pre-Spring statement, much was being made of Sunak’s so-called “fiscal headroom” – having more money to play with was than predicted at the spending review would allow Sunak to spend more on public services, welfare or tax cuts if he chose to. That’s your blue/grey bars here.

As my colleague David Kernohan points out, that headroom had been bolstered significantly by Donelan’s decisions on the uprating of maintenance loans this September, the freezing of the repayment threshold this April and the changes announced in the post-Augar package. In other words, Sunak’s planned tax and NI cuts – which will be a bigger boost to higher earners – are being balanced on the backs of students (who get less spent on their education and maintenance) and graduates (most of whom will pay more for their privilege).

It’s easy to get into the weeds of who will and won’t benefit in the longer term, and to question why and how the Treasury can get away with burying these “balancing” measures in separate DfE announcements. The more pressing question is that of student hardship this coming September.

On the morning of the spring statement, the Office for Budget Responsibility announced that it projects inflation to be 7.4 percent this year. Remember inflation hits harder for those on lower incomes given their basket of goods – let’s thumb it at 10 percent for students. Also remember that the value of the English maintenance loan is only due to increase by 3.2 percent this September – and DfE is (still) freezing the £25k household income threshold over which we start reducing down from the full maintenance loan.

I often come across people who haven’t really thought all of that through – but let’s consider that for a minute. Augar argued that the peg for the maximum maintenance loan for a full time student should be the country’s minimum wage, at 37.5 hours a week term time only. That’s £10,687, but this September ther max loan will only be £9,706 for those away from home outside London.

We actively expect students for whom that figure won’t be enough to go out and earn more than that in part-time or seasonal work. But it’s worse than that. If their family is earning more than £25,000 – and if both parents are themselves full time on minimum wage, that we’re talking about £10k more than the £25k threshold – we start deducting from that max loan. Chuck in inflation at about 10 percent, and you have a bonafide crisis coming.

Help for the hardest hit

Will Sunak’s measures – which he says were designed to help households on the lowest incomes – help? First, let’s remind ourselves of this little scandal buried in one of the Treasury’s accompanying documents to the spring statement:

To align with the definition of income used in DWP’s Households Below Average Income publication, the analysis of spending on public services also includes financial transactions through student loans. To account for this source of income, estimates of student loan outlay in a given financial year are counted as household income from public spending. Likewise, estimates of student loan repayments in that same financial year are reflected as a loss to households, again through the public spending bars.

Yes, as we’ve noted on here before – the Treasury comforts itself that it’s helped households on the lowest incomes by treating the value of tuition fee loans as disposable income – so an HMO of five full time students looks £46,250 better off than it actually is. What a disgrace.

Sunak’s measures for drivers won’t help low students much – they’re unlikely to be impacted directly by prices at the pumps. Measures on reducing the cost of energy efficiency measures only highlight that we have no plan for causing landlords to make notoriously inefficient HMOs reduce bills for tenants. And £500m in discretionary funding for local authorities is unlikely to find its way into students’ pockets – not when most councils excluded students from their discretionary funding over Covid-19.

Can universities help?

It’s easy – and in this case right – to point the finger at government, although the lack of outrage about student finances when compared to commentary on university finances from the sector is as miserable as it is predictable. But there are other things that should be done now as the crisis unfolds.

First, as he prepares to issue advice on Access and Participation plan revisions, it’s now unthinkable that John Blake doesn’t ask providers to factor in predictive thinking and preparatory work on all this for their lower-income students. The point about impact evaluation and student engagement is that it should allow you to predict the impact of your interventions. If we get to September and everyone feigns surprise about the problems here for low income students the sector will have failed.

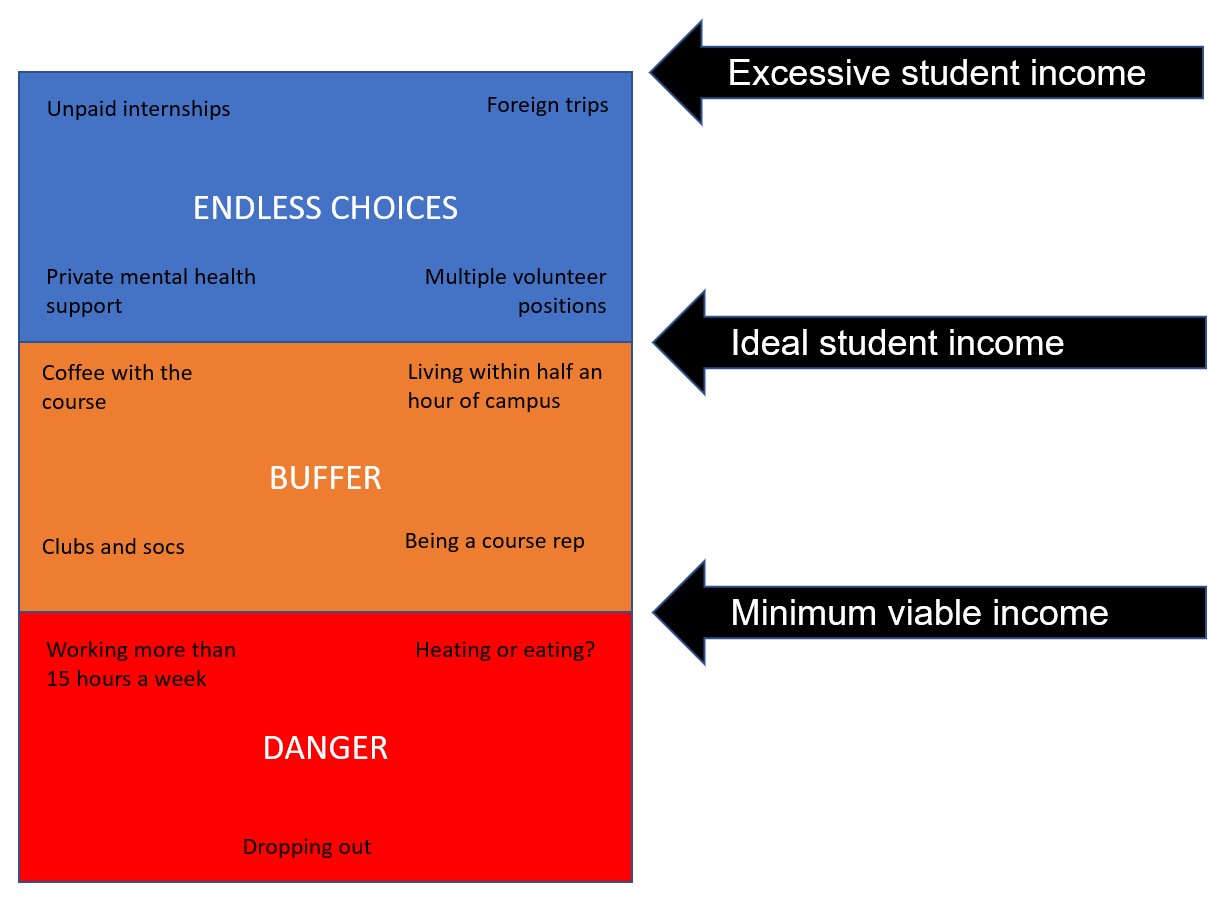

I often try to explain the situation facing students like this. For a given student in a given mode on a given course in a given area, there’s likely to be a minimum viable income that allows them to stay on the course. Go below that and things get very tough indeed, where worse results dance with full-time work or surviving on credit cards and food banks. There’s then an ideal student income, allowing a student modest social life (a coffee before a lecture, not a club night) and the the ability to participate in wider student activities like student representation, volunteering or clubs – the sort of thing that gives you the social capital and the soft skills that give you an edge in the labour market.

The big problem with the cost of living crisis isn’t so much that we’ll instantly see a lot of students drop out or not go into higher education. It’s that there in the buffer is where the difference is made. It’s where students choose to go the best university for them, rather than the offer that’s most local. It’s where they feel “belonging” because they can afford a round of lattes, and where they build their career because they could afford the bus in for that careers event. It’s why these students were right when they urged John Blake to turn attention to student activities as well as just “getting the grades” when thinking about his agenda.

Double down

As well as all that, the entire sector should double down on reducing costs for students. Everyone – from module leaders to catering managers – should be asking themselves, or ideally students, whether there are things in their purview that could reduce costs for students. Nobody’s plans for next year should be approved anywhere in HE without some narrative on the issue – no extraneous books on reading lists, no price lists without budget options, no lab coat requirements without second hand alternatives, no placements announced without carshare support.

Similarly, the sector should double down hard on creating, offering and operating decent employment opportunities for students. Other than soaring anxiety, you want to know why students aren’t turning up to your carefully crafted lectures? It’s because they’re knackered and have no time, because they’ve been earning the junior minimum wage rate in the nightclub in town or the overnight shift in Asda.

We shouldn’t forget international students. Universities that blithely tell the cash cows that fees will only increase by inflation will now have to point out just how high inflation can go sometimes – that’s going to hit the more modest family incomes from the regions we’re now filling boots from very hard. And as I said on the site the other day – we really need to warn international students on costs too – and have hardship funds ready when things get too tough.

We shouldn’t forget the implications for students on PGT and PGR courses either. PGT fee increases are now consistently outpacing increases to the combined maintenance and tuition loan, which eats into its own kind of buffer. And the situation for large swathes of PGR students is really grim – illustrated ably by Ben Fisher in his thread on Twitter.

Amd we urgently need to understand the implications for students in the nations – especially Wales. Complex changes to devolved funding formulas when the Treasury saves money on student loans will work their way in to devolved budgets eventually – and the traditionally more generous settlements for students, principally on fees in Scotland maintenance in Wales, may have to be revisited.

But the biggest thing on my mind is about “efficiency”. Reflecting on the post-Augar settlement, most of the sector seems to think it’s dodged a bullet because student numbers won’t be slashed deep overnight – instead the unit of resource will contract as universities are asked to become more efficient. It will make industrial relations even more strained and see some provision become impossibly thin, but for for the opportunity advocates, it has the advantage of helping to meet demand for HE in the coming decade.

But when we become more “efficient” in this way, we’re obviously not only spending a bit less per head on the teaching and the buildings. We’re also saying to low income students that they can still come, but they’ll have a viscerally worse experience than their better-off peers. Where four students from a low-income background used go into higher education and now six go, we mostly pat ourselves on the back over access. But if those four used to have a decent experience, and now the six have a terrible time, is that progress? I’m not nearly as sure as some that it is.

Brilliant piece. Thank you.