I would like a place I could call my own

Jim is an Associate Editor (SUs) at Wonkhe

Tags

Last year, the city was languishing last out of 32 student cities as the least affordable for students in the UK.

So presumably the SU has been campaigning hard, the university has been slashing the costs of catering, and local landlords have been giving rooms away for half the price.

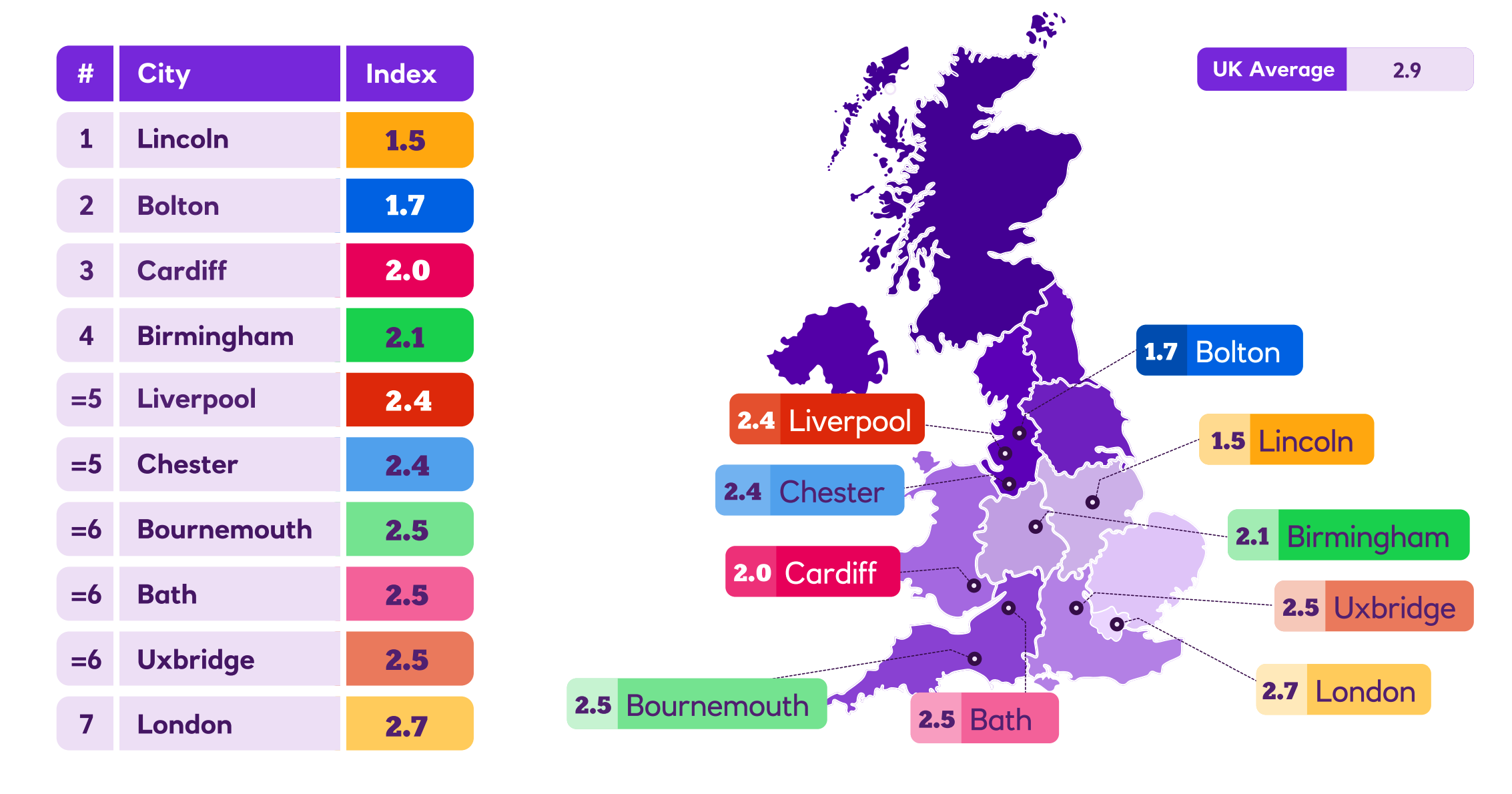

Because this year, it turns out that Lincoln is now the cheapest city for students in NatWest’s Student Living Index 2025. Quick! Stick it on the clearing ads!

The NatWest Student Living Index – now in its tenth great year – is a widely reported piece of work that emerges during Clearing every year as a hook to promote its student bank account.

On everything from spending and budgeting to coursework and nights out, it purports to be a crucial source of “inside knowledge” on university life.

There’s plenty of surveys of this sort that appear around now to promote things that businesses want to sell to students or their anxious aunts and uncles.

The difference with this one is that universities have tended to use the results in their marketing – hovering around in that grey area between “coax them in with promises of cheap pints” and “accurate information, advice and guidance that stops students from going broke as soon as they arrive”.

The problem? Where do I start.

Last year, the press release from NatWest towers tried to suggest that the amount of time that students were spending in part-time work had increased on average by 154 per cent in one year.

The year before, it attempted to convince us that students’ average income had somehow rocketed – from £1,805 a month to £2,893 a month.

In 2022 we were told that average monthly rents in Edinburgh – at the time facing extreme student housing supply constriction – were just £200 a month, and in 2021 we were told that students in London were somehow spending £9.10 on a pint.

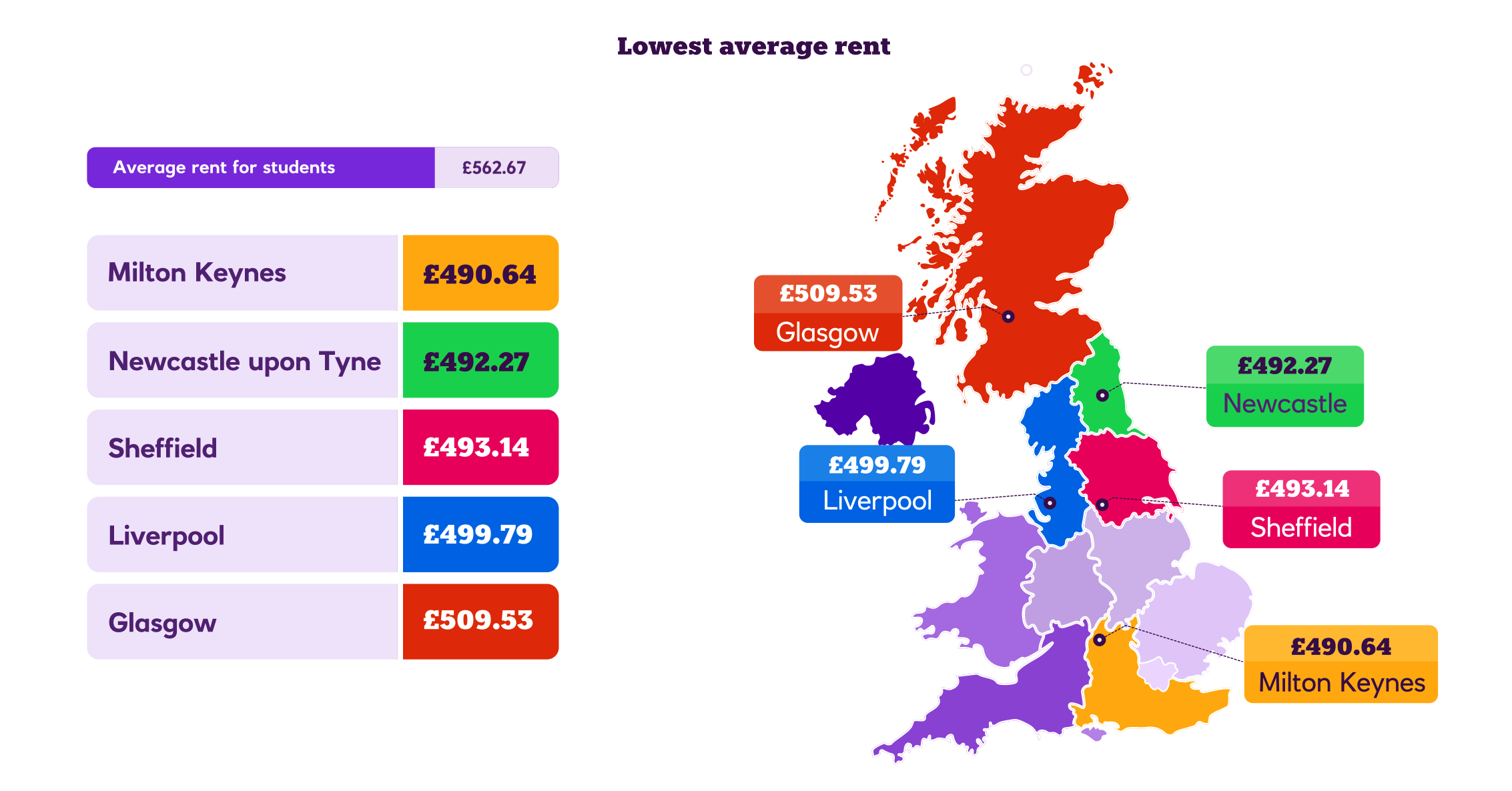

This year, we’re being asked to believe that average rents have fallen from £689.43 a month to £562.67, that spending on household bills has fallen from £157.78 to £124.08 a month, and that spending on clothing, shoes and accessories has somehow jumped from £52.20 a month to £123.30 a month. It’s your time to Shein!

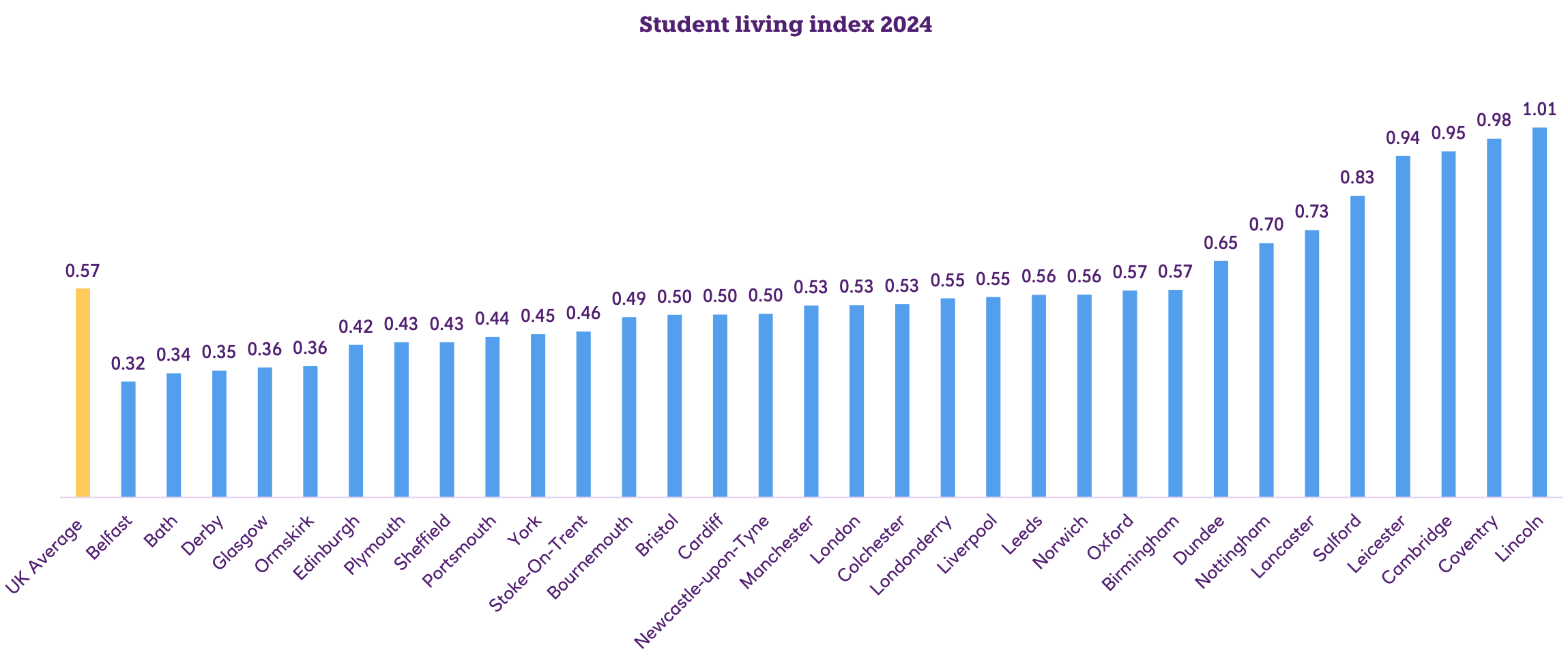

The central conceit of the exercise is, for some reason, to take average monthly living and accommodation costs and then divide them by average monthly income – all while, for some reason, excluding the student loan that home students in the sample have. That then supposedly gives us a “Student Living Index” score for each university town and city.

That then gives us that chart above, which laughably appears to be suggesting that London is the joint seventh cheapest student city in the UK.

This is all derived from a survey of 5,001 undergraduate students – a sample which does not appear to be weighted for any characteristics, and bases any reported city results on sample sizes of 50 or more.

As a result, the results are pretty much impossible to trust at both local and national level. If rents had really dropped nationally by 18 per cent in a single year, letting agents across the UK would be sobbing into their spreadsheets, and we wouldn’t be seeing reports of students commuting in from other cities or living in hostels.

It produces graphics like this, which seem to be suggesting that the famously inexpensive Glasgow student rental market is the UK’s fifth cheapest. Or at least it is for the 50 or so students (it could me more, we”re not told) that reported out of the circa 70k students in the city.

Likewise, clothing and fashion spend more than doubling year-on-year, in the middle of a prolonged cost-of-living crunch, with every other survey showing students cutting back on non-essentials, is obvious nonsense.

Any serious cost-of-living index worth the name would:

- Include the biggest single source of income most home students have – the student loan – in its affordability calculation.

- Weight the sample to reflect the actual distribution of students by institution, region, course type, and demographic characteristics.

- Report confidence intervals or margins of error, especially when city rankings are based on tiny subsamples.

Instead, we get an unweighted, self-reported survey where a handful of respondents can swing a city’s ranking dramatically. Fifty undergraduates saying they pay £400 a month in rent can transform a supposedly “national” picture, and down at the provider level a couple of international students can skew the sample beyond all meaning.

Because the “index” divides monthly costs by an income figure that’s both incomplete and volatile, the final score ends up being more a reflection of quirks in the sample than any underlying truth. That’s how you end up with the fantasy scenario where London – where every credible rent dataset puts student housing in crisis – emerges as one of the cheapest places to study.

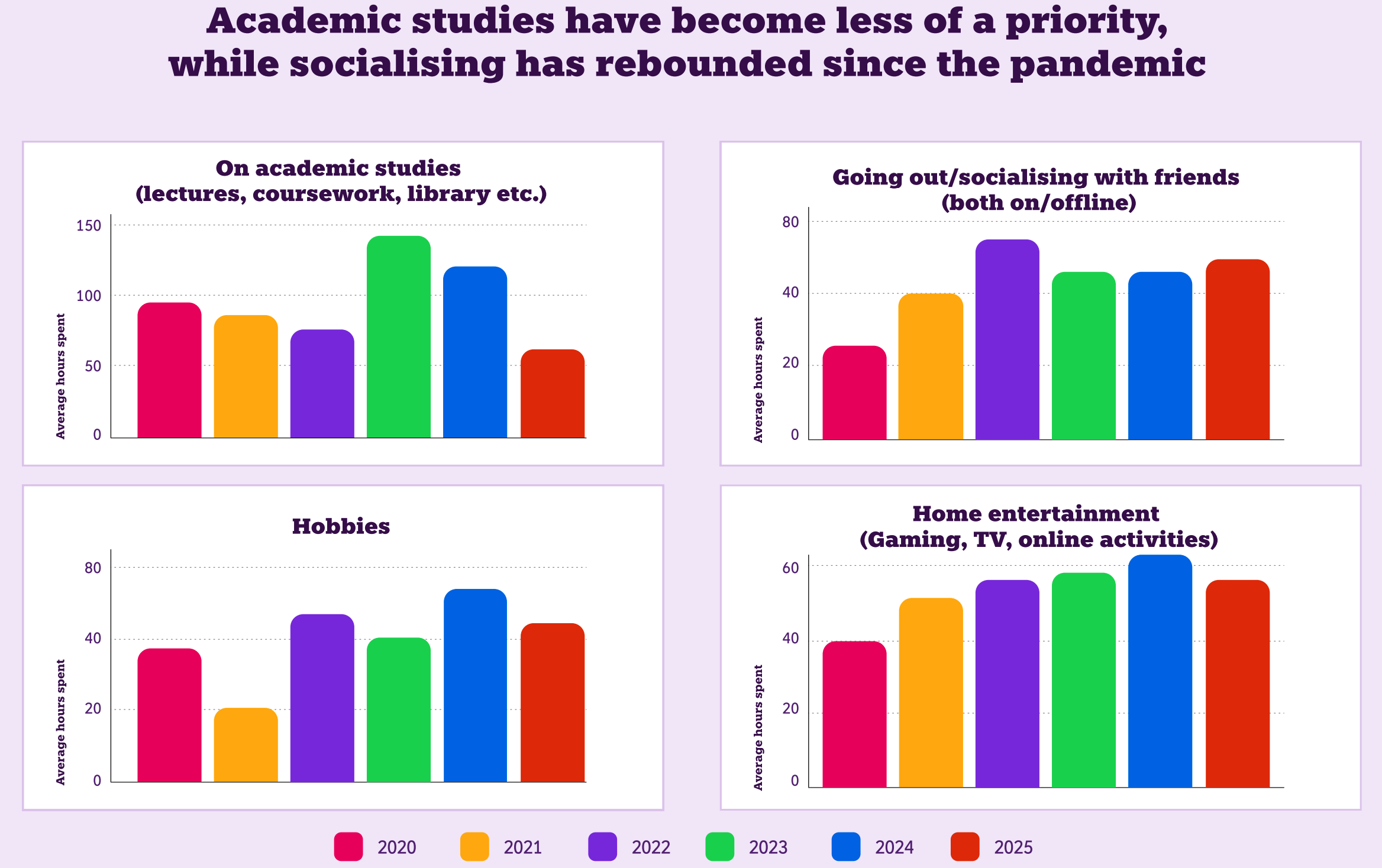

There’s also some lifestyle stuff. Imagine working up the graphics for this chart – which seems to be suggesting that the UK’s undergraduates have more than halved the time spent on studies YOY – and not raising a red flag.

When you strip away the NatWest branding and PR gloss, you’re left with a dataset that is at best a fuzzy snapshot of what 5,001 self-selected undergraduates happened to tell a market research agency in April. At worst, it’s an unreliable mash-up of incomparable numbers, used to create rankings that some universities irresponsibly drop into clearing ads without caveats, and that prospective students (and their parents) might actually rely on to build a budget.

For the avoidance of doubt, I’m not suggesting that Savanta (the firm used to carry out the polling) have made anything up, or that the figures are anything other than an accurate reflection of the sample that it collected the information from. It’s the design of the exercise, the sample sizes used, the failure to weight and the drilling down by town and city that render the exercise utterly meaningless.

In silly season, the odd dodgy survey from a company trying to flog things to new students is probably fine. But as I’ve noted in previous years, this is an actual high street bank – whose figures may be relied upon by prospective students to do their budgeting.

Students still need much much better, nationally coordinated, accurate and up-to-date information on this sort of stuff – and surveys like this from bodies like banks really ought to be banned.

But as long as they’re still being published, the very least that universities can do is to refrain from bragging about how well they’ve done in them. That will help avoid any later… regrets.

this suggests some gaming by some in the sector or a seriously flawed methodology. I do not doubt that Lincoln is a relatively cheap Uni city/town btw. The impact of more students living at home (inc in London) may also be feeding into the data. The complete university guide/what Uni has it’s own robust cost of living calculator and UCAS are about to launch one too I hear.

I would agree with you Jim as far as Lincoln being a pretty cheap place to live – albeit because the area has low income – therein lies another story. I grew up in the area. It would seem that the NatWest survey could feature in the Edinburgh book festival’s talks as fiction.

There doesn’t seem to be a link to get any more data than is in the presentation. There are more questions…

For example: why are only the top ten towns listed in the affordable ranking? Elsewhere Milton Keynes pops up (lowest average rent and lowest average spend each month on entertainment, going out, travel, food and items by city and second lowest estimated average spend for a night out) – who are these undergraduates?