The Sunday Times publishes the six universities with the highest lost loan fraud

Jim is an Associate Editor (SUs) at Wonkhe

Tags

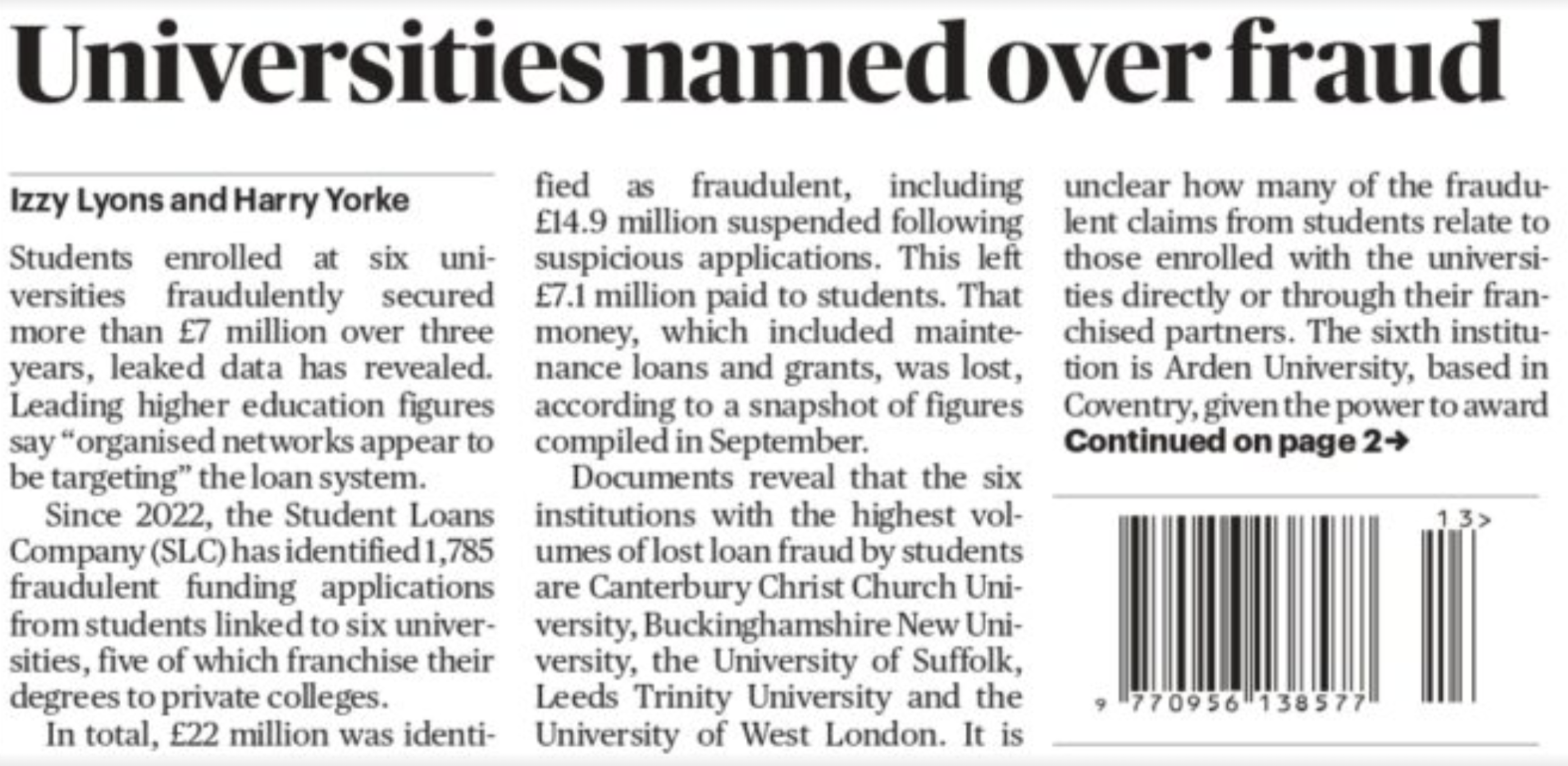

Now its front page names the “six institutions with the highest lost loan fraud by students” – said to be Canterbury Christ Church, Buckinghamshire New, Suffolk, Leeds Trinity, West London and Arden.

The story says that leaked data reveals that students enrolled at them fraudulently secured more than £7 million over three years – since 2022, the Student Loans Company (SLC) is said to have identified 1,785 fraudulent funding applications from students linked to the six, five of which franchise degrees to private colleges, and one of which is itself a private college.

The leaked documents also reveal that £22 million was identified as fraudulent, including £14.9 million suspended following suspicious applications – leaving £7.1 million paid to students. That was “lost” according to a snapshot of figures compiled in September.

It’s worth noting in passing that all six appear in the top right-hand quadrant of the chart that my colleague David Kernohan has been compiling on providers that have more students taking out maintenance loans (at a higher value) than tuition fee loans for a few years now – and all five public universities appeared in OfS’ sample student outcomes dashboard on subcontractual partnerships published last December – although the paper says that it is unclear how many of the fraudulent claims relate to those enrolled franchised-out rather than taught directly.

The paper quotes education secretary Bridget Phillipson as saying that “the buck stops with” universities – but there’s an interesting question in the piece over who knew what and when.

The story says that the universities were not initially made aware by the SLC of the fraudulent claims from students, which are, it says, “categorised under a civil burden of proof rather than criminal”. Canterbury Christ Church, for example, is quoted as saying that the figures had only been passed to it “very recently”:

The [SLC] has not provided the university with information on either the nature or the details of these individual cases. The university has over 30,000 students and the figures should be considered in this context.”

Suffolk even says that it did not “recognise nor accept the figures” and that the SLC had provided them with different numbers:

We unequivocally condemn any misuse of public funds and are committed to working closely with all partners and regulators to enrol genuine students with the ability to succeed in higher education.

It does all raise policy questions about the extent to which the existing system has enabled (or otherwise) universities to get on top of the problem.

Each of the five public universities has a quote in the piece, as well as a quote from the SU President at Arden. All argue that fraud is unacceptable, that they take the misuse of public funding seriously, have strict controls to detect fraud including monitoring attendance, and that those doing franchising audit partners and interrogate admissions procedures:

They noted that much of the fraud was beyond their control and they too were victims.

Fraud is of course important – but the figures quoted are barely rounding errors in an annual outlay of about £9bn. Whether the Sunday Times gets onto wider questions of quality, access or outcomes in due course will be something to watch.

The other thing to note is that the only franchised-to provider actually named in the piece is Oxford Business College. UWL is quoted as saying that 70 per cent of the fraudulently claimed funding was from students taught by the provider that was featured heavily in last week’s story (and the NYT story from 2023):

The numbers of illegitimately claimed monies have fallen dramatically since, and we anticipate this trend continuing.

For OBC – which doesn’t appear to have a current HE partner, even if it’s still engaged in teach-out – as well as other large private providers (both franchised-to and on the register), real questions now surround potential impacts on business and viability if a mixture of bad publicity, impending regulation (including a dangled ban on domestic agents), closer scrutiny and claw-back from lead providers of money clawed-back from them all take their toll.

Sympathy (or otherwise) for them is one thing – but if an ABA scenario was to come to pass (it pretty much went bust when DfE blocked funding), the volume of real students suddenly having to be placed in other providers via Student Protection Plans in disorderly exit scenarios would almost certainly be huge. There may well also be impacts on the universities named and shamed here that intensify whatever financial issues they might have.

If disorderly exits do happen, adding to the list of questions over whether lessons learned since GSM London’s closure in 2020 will be another one – what OfS has known and when, and whether enhanced steps over Student Protection Plans with relevant lead providers have been taken in response to what very much feels like enhanced risk.

So, the common feature is emerging not to be franchising per se but the operation of city centre branch campuses. Five of these universities do it through various campus partners, the other does it directly. The Sunday Times misses that this university is under a B3A Notice to improve outcomes for students; the assessment report having noted it was at increased risk of a future breach as student numbers were expanding fast. It noted: “Our data shows that there were 1,380 entrants to full-time, first degree programmes in 2017-18, which had increased to 5,540 entrants in 2020-21. This illustrates the… Read more »

Which uni? “The Sunday Times misses that this university is under a B3A Notice”…

I always find it interesting when a claim is made that Humanities programmes somehow provide “critical thinking” that others do not. All programmes provide critical thinking. Would you want to fly in a plane that was designed and built by engineers with no critical thinking skills? I doubt it. I think what is meant is different critical thinking, but then it opens the question of whether this critical thinking is adequate and necessary at scale for society today in comparison to previous generations. I’d always recommend studying a subject based on passion as it ensures engagement and success (computer science… Read more »