Should we charge graduates £10k more each (unless they’re rich)?

Jim is an Associate Editor (SUs) at Wonkhe

Tags

A new policy note from HEPI’s Nick Hillman considers a basket of “alternative parameters” for English student loans, including the removal of “real” interest rates, an increase in the repayment period from 30 years to 35 years, and reducing the repayment threshold to a little under £20,000.

And it finds that the first of these options would increase the cost to Government while the other two would reduce it.

That matters as we move towards a spending review where the mood music from DfE and the Treasury is that skills and FE are the priorities, and that it will have to be changes to higher education that pay for it.

As I’ve said on the site before, if we think of the English undergraduate funding system as some kind of Bermuda triangle with a) student numbers, b) the unit of resource and c) the contribution scheme all in play, it’s clear that the latter will have to contribute its fair share to whatever goal is being set by the Treasury. And the more that the first two are shown to be difficult in practice, the more chance we will end up with the contribution scheme carrying more of the weight.

That gives you options – and hot on the heels of some of those options being surfaced by London Economics modelling for a couple of SUs comes some London Economics modelling for HEPI that weighs them up.

First of all the abolition of the real rate of interest (which HEPI notes is thought by some policymakers to be an unpopular feature of the current system) turns out to cost £1.2 billion, increase the RAB charge by seven percentage points to 61% and would be regressive – helping only the best-paid graduates (because others never get close to paying off in full, irrespective of interest, before the 30-year cut off). And there’s a gender issue too – the repayments of men would fall on average by £6,400, but the repayments of women would fall by £1,300, because of the graduate gender pay gap.

You could play around with the repayment rate, although that’s not modelled here – and nor is raising the interest rate. So what’s then left is the repayment term (the number of years before the “loan” is written off) and the repayment threshold (the amount of money you have to be earning before you start paying something back).

Here HEPI/LE model extending the repayment period from 30 years to 35 years, a move it says would save the government / taxpayers just under £1 billion and reduce the RAB charge by four percentage points to 50 per cent. The note says that doing so would have no impact on graduates with the lowest incomes (who would continue to repay nothing) nor graduates with the highest incomes (who would continue to pay off their full loan before the original 30 years were over).

But it doesn’t mention the distributional issues in the middle – when those students’ unions asked LE to model a 36 year term a few weeks back, the resource transfer from graduates in the future to now would make middle-income male graduates £3,000 worse off, with higher-earning female graduates up to £11,000 worse off. In this scenario there’s a significant detrimental impact on the “typical” graduate and a relatively minimal impact on the highest earning male graduates.

That leaves you with the repayment threshold. The story here is that the 2012 system had pegged it at £21,000, but shortly after Theresa May’s disastrous snap election, first secretary of state and effective Theresa May deputy Damian Green had for a “national debate” on tuition fees and loans at a conference hosted by the Tory think tank Bright Blue.

In a speech and Q&A that in part sought to reflect on Corbyn’s so-called “youthquake”, he argued that the party needed to “change hard” to woo young, educated voters who backed Labour:

I think this is clearly a huge issue. I think in the long term we’ve got to show that they are getting value for the money. If we want to have 40%-plus of people going to university and if we want those university courses actually to be valuable, which I think is where the strain is often taken in European universities – you actually look at the teaching that you get in some European universities, you have lecture halls with 600 people in and things like that – it’s not actually as good a teaching and learning experience as you get in this country.”

Various proposals were then commissioned over the summer on things that could be done, and there was talk of infighting over their presentation. But then at the very last minute, Theresa May pulled a classic “conference gimmick” out of the hat to accompany her review of the scheme:

We want everyone to have the opportunity to benefit from studying more after they leave school. Because it’s good for them and good for the country too. But today, young people take on a huge amount of debt to do so. And if we’re honest, some don’t know what they get from it in return. We have listened and we have learned. So we will undertake a major review of university funding and student financing.

We will scrap the increase in fees that was due next year, and freeze the maximum rate while the review takes place. And we will increase the amount graduates can earn before they start repaying their fees to £25,000 – putting money back into the pockets of graduates with high levels of debt.

The repayment threshold component turned out to be a spectacularly expensive commitment with barely any political recognition or credit flowing back to government – so in an era where the Conservatives seem more comfortable courting the working class over 50s than urban remainder graduates, you can see why those involved in the development of the post-2012 system might lean toward pushing the threshold back down again.

In the new modelling, a repayment threshold matching that for pre-2012 student loans (taking it from from the current £26,575 down to £19,390) would reduce the cost of one cohort of students by almost £3.8 billion – split by £2.2 billion less on tuition fee loan write offs and £1.6 billion less on maintenance loan write offs.

And if this repayment threshold were extended to all those who currently face the higher threshold, then the loan write-off would fall from 54 per cent to 33 per cent – roughly the expected rate when the current system was introduced. It would also reduce the proportion of former students who do not repay their entire loan from around nine-in-ten (88 per cent) to three-quarters (76 per cent) and halve the proportion who never repay a penny (from 33 per cent to 16 per cent).

Alas, things are never quite as simple as they look. On average, the modelling finds that both male and female graduates would repay around £10,000 more. But the policy note is noticeably quiet on the impact on different graduate earnings profiles – and it’s pretty plain that a change like this would hit lower earning graduates harder. As LE notes, “In general, the highest earnings graduates are unaffected as they would have repaid the entirety of their loan balance well before the potential extension of the repayment period.”

Then there’s the unilateral change to repayment terms for existing borrowers issue. Are we really going to turn around to students who’ve been calling for rebates and refunds for the past eighteen months and hit them with an “on average” £10k extra in repayments that regressively hits less successful graduates? “NOW THE TORIES WANT TO PUT UP THE COST OF HE BY 10K EACH”, etc etc

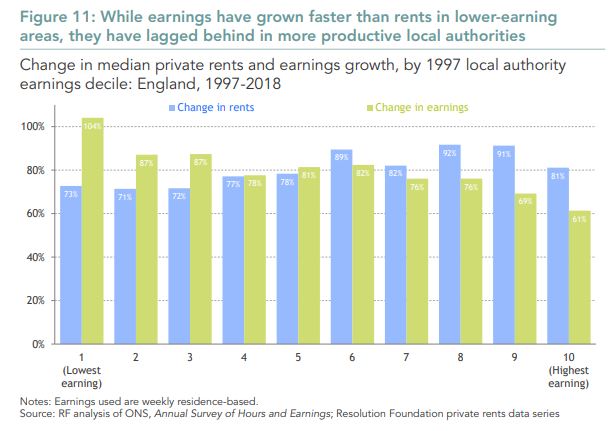

And anyway – it’s not 2010 any more. The situation for graduates has changed – Theresa May might have been making it up for a speech, but she was at least economically on to something. We know that more graduates than ever before are having to return to their parental home, and where graduates are renting, they’re more likely to rent in areas where earnings are eating up a higher proportion of their incomes (because housing costs are rising fast in graduatey towns and cities but wages haven’t been growing as fast).

And governments’ successive failures to address student hardship might not have put students off from university, but it has meant a rise in commercial debt on graduation. Remember that MoneySupermarket stat from a couple of years ago – it found that average commercial debt on graduation is £3.5k and £10k for the tenth decile. No special “repayment thresholds” apply there.

What all of that points to is a need to support graduates in their twenties by raising the repayment threshold, rather than lowering it – all of which leaves you with “raise the interest rate and make the richest graduates pay more”. As I said on the site the other day:

In this Gordian knot shapeshifter of a hybrid system that we have – which presents as a loan one minute and a graduate tax the next – it reminds us that the more we move the system “back” towards a traditional loan scheme, the more regressive such a move would be.

In an ideal world higher education would be free to all, but we are far from that. If we as a society were more progressive in our tax regime then this could be achievable, however being realistic that doesn’t seem to be happening anytime soon.

Lowering the payment threshold seems like the least worse option given the other alternatives and perhaps it might have the unintended benefit of breaking the current Govt. obsession that good graduate outcomes are linked to high earnings, as this mind set does seem to be influenced by the need for graduates to repay their loans.

It’s certainly the least worst of the options HEPI has here. How about raising the interest rate? That would hit the richest graduates who get to pay off in full before the 30 year write off kick in.

“If we as a society were more progressive in our tax regime then this could be achievable, however being realistic that doesn’t seem to be happening anytime soon.” @Phil Berry After accounting for all tax deductions and benefit payments, the ratio between the richest and the poorest quintile is less than four. The worst (ie least progressive) feature of UK taxation is Council Tax. A Commons Early Day motion was tabled in March for a proportional property tax. You could write to your MP asking if they intend to support this reform. While scarce resources can by definition never be… Read more »