On the ABA closure, were lessons learned since GSM London’s closure in 2020?

Jim is an Associate Editor (SUs) at Wonkhe

Tags

DK covered what we know on the site on Tuesday. Since then it’s become pretty clear that this is a whole provider closure:

I, for example, have a raft of questions about the way agents were selling ABA’s courses. Did the universities franchising to it or validating its provision know that these were the sorts of tactics being used? What are other universities’ whose franchised courses are still being sold like this doing? When is DfE going to get around to telling us about its review of agents?

In July, the Applied Business Academy appeared to sell off 99 per cent of itself. Why, and who to? And how was it allowed, if it was on the OfS register, to never comply with the OfS accounts direction that would have told us things like how much its head of provider was being paid?

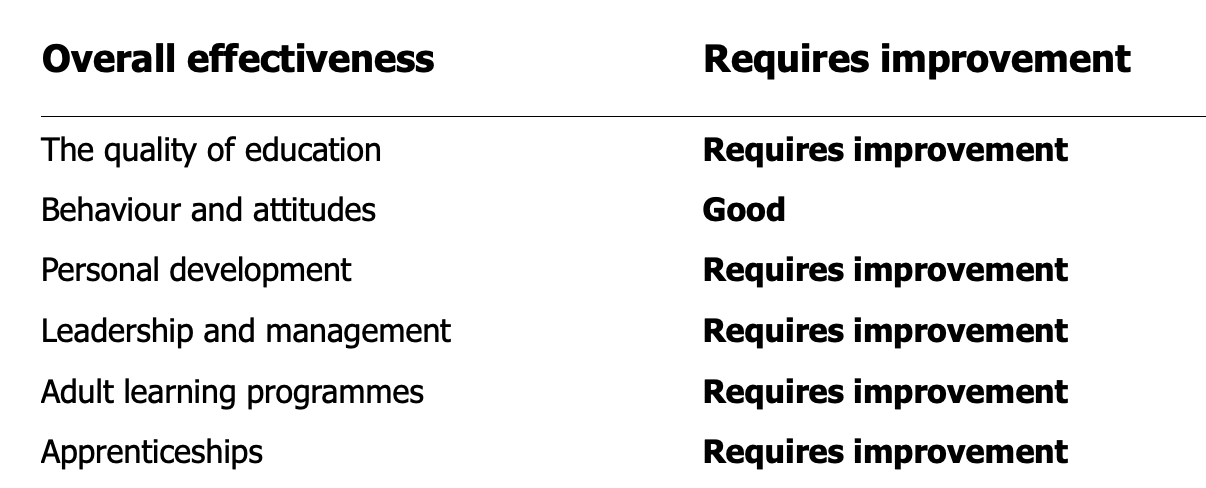

In 2022, the academy got a “requires improvement” in all but one of Ofsted’s inspection categories for its apprenticeship provision – including for leadership and management and several questions about quality. Did this trigger (in its famous “risk based” framework) any alarm bells at OfS re its own conditions of registration?

Was it the case that the suspension of tuition fee payments effectively triggered ABA’s decision to pull out, or enhanced regulatory attention, or both or neither? Did it run out of cash? That all matters because if there’s a wider problem with franchising (and a whole OfS insight brief suggests there is), the danger is that OfS and/or DfE puts students at risk if it intervenes – yet also puts them at risk if it doesn’t. Students in similar provision deserve answers – now.

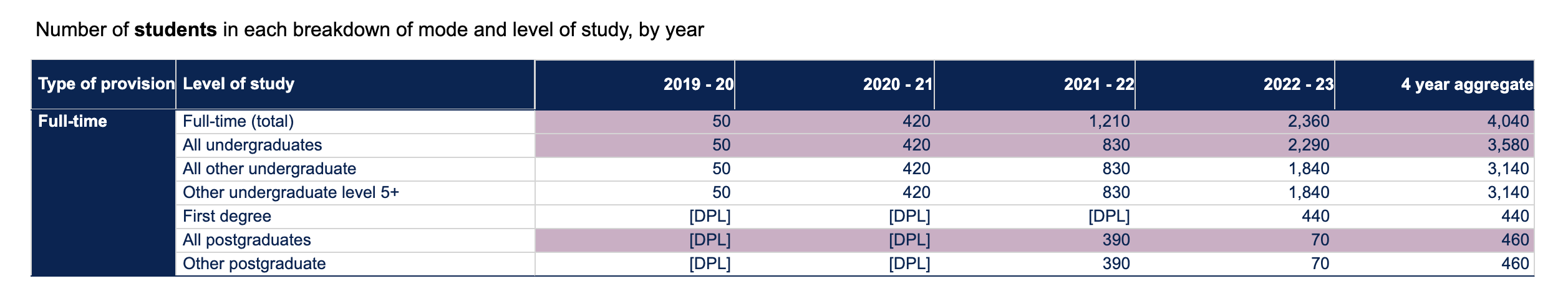

These numbers – from OfS’ size and shape dashboard – suggests that 2,360 full-time students were studying at ABA in 2022-23. But OfS says that “up to 300 current and prospective students are affected” by the closure. How can that be? The growth suggests that the 2,360 students weren’t all final year students. What’s happened to everyone else? Or is it that nobody’s worried about anyone on a Level 5 or below course?

Leeds Trinity’s “live” Student Protection Plan rates the current risk of a failure of an academic partnership to be “low to moderate”. Is that really how it’s been rating the risk over the past year – given OfS says it’s been “engaging with ABA over the past year in relation to compliance with our ongoing conditions of registration”. And if not, why is that the live plan?

Meanwhile the University of Buckingham’s SPP doesn’t seem to give a rating to the likelihood of risk of a collaborative partnership failing at all. Why does OfS allow some SPPs to not include that information for students?

ABA was on the OfS register – its own SPP, marked “Currently under review”, says that the risk that it will “no longer able to deliver courses to students in one or more subject areas and/or departments” is “low” because it has a “rationalised and clearly defined course portfolio” and “there are no considerations or problems in any of these areas.” Why was this the current published plan when it’s been under formal investigation since April?

OfS Condition C4 (student protection directions) was introduced to enable it to intervene more quickly and in a targeted way when it considers there to be a “material risk” that a registered provider may cease the provision of higher education. It included the ability to require production of a Market Exit Plan for approval, implementation within specified timescales, other Student Protection Measures, and things like publishing information, allocating resources, and consulting an insolvency practitioner if required. Was such a condition imposed? Does this count as a “market exit”?

On OfS’ information for students page, it says that students may also be entitled to compensation for the disruption and associated costs. ABA’s own refunds and compensation policy certainly suggests so. On an assumption that it may not have had much cash to play with (not least because of the tuition fee suspension issue), what are the chances that students will get any compensation owed to them? And if not does OfS now consider that Leeds Trinity and/or Buckingham become liable?

Below, OfS tells us that DfE stopped paying tuition fees “to” ABA – if we presume that Leeds Trinity did have some franchise students there, has DfE stopped payments to them and/or asked for money back from them?

When OfS announced that it was opening an investigation in relation to Applied Business Academy, it said it would consider whether it had complied with its general ongoing conditions of registration relating to provision of information to OfS and to its designated data body (ie HESA), and whether it had effective management and governance arrangements in place.

It also said in February that it had opened an investigation in relation to those issues in relation to whether Leeds Trinity had effective management and governance in place for subcontractual partners. Was ABA the only of LT’s partnerships that OfS was concerned about? If there are others, is that because they’re not on the register (and so students can’t know)? And did OfS take steps to ensure that students were warned of the enhanced risk environment they were studying in or applying to in February, April or since?

Given we know that DfE instructed the Student Loans Company to suspend all tuition fee payments to ABA, if any were supposed to come in since, are these still showing up as incurred student debt for the students they are attached to? And given the “protection” arrangements have manifestly failed in this case, is DfE considering writing off some or all of the debt incurred beforehand for those students?

And crucially – have any of the lessons been learned since GSM London went into administration in 2020?

We reached out to OfS and got the following:

Protecting students in the event of course closures such as these is a key priority for the OfS. As you will know we’ve got a number of tools that we can use in these situations, including student protection directions as well as holding providers to the measures set out in their student protection plans.

Where partnerships arrangements are in place, we expect franchise partners or validators to step in to protect students. We’ve been working closely with ABA, the University of Buckingham and Leeds Trinity University to ensure that students are able to transfer to a suitable alternative course, receive records of their academic attainment to date, as well as other advice or guidance they might need.

We asked ABA to review its student protection plan as information emerged about its access to SLC tuition fee payments. The plan remains in place while the provider discharges its obligations to students and the University of Buckingham and Leeds Trinity University will also be supporting students.

[OfS may well have asked, but at least in public, ABA didn’t seem to comply).

As you know, the Department for Education instructed the SLC to suspend all tuition fee payments to ABA, until the OfS has completed its investigation into ABA. Students registered on ABA courses remain eligible for maintenance support payments from the SLC. Any questions regarding DfE’s decision-making process should be directed to DfE.

On complaints, we’re working very closely with the OIA, Leeds Trinity and the University of Buckingham to ensure that students are aware of who to contact in relation to any complaints, or queries about compensation. With our support, Leeds Trinity and the University of Buckingham are working to assist these students with whatever they decide to do next.

On investigations, we would normally expect to publish investigations when they are opened, although we take individual publication decisions in each case. We have announced investigations into both ABA and Leeds Trinity, and set out the issues each investigation is considering. We don’t comment on investigations while they are in progress.

SPP are meant to cover students with whom a provider has a contractual relationship, which explicitly doesn’t cover validated students, who don’t. I know the OfS now wants SPP to include validated students (and, in its typical 1984 fashion, has confirmed this has always been the case even when they previously advised it wasn’t), and I think providers should have this kind of obligation (and did with the QAA). But it’s still annoying. Same goes with the OfS’ belated response to the regulatory problem it created by incentivising this kind of dangerous franchise provision, which is so far a blanket… Read more »