The poorest students are getting £1,500 less in loans than they should be

Jim is an Associate Editor (SUs) at Wonkhe

Tags

During Commons education questions on Monday, Patricia Gibson (a backbench MP from the SNP) noted that in the Autumn statement, the Chancellor spoke for nearly an hour but failed to mention students once.

Gibson went on to quote some of the material from last week’s ONS release, asking why the Government is neglecting students who she said are “buckling under the pressure” of the cost of living crisis.

As such this was a great opportunity for new Secretary of State Gillian Keegan to reassure students that they weren’t being ignored. Her answer?

I assure the hon. Lady that the Chancellor did mention teaching and all our teaching staff, which of course includes university teaching staff.

What?

Keegan went on to say that the Department for Education was working with the Office for Students to ensure that universities support students in hardship by drawing on the £261 million student premium (the so-called “magic money twig”), and advised that any student who is struggling should speak to their university about the support it offers:

Many universities are doing a fantastic job to provide further support: the University of Leeds has increased its student financial assistance fund almost fivefold to £1.9 million; Queen Mary University of London has a bursary scheme for lower-income families; and Buckinghamshire New University has kept its accommodation rates for halls of residence at pre-pandemic levels, so a lot of support is on hand for students.

It’s barely worth unpicking the spectacular inadequacy of that answer – not least because in those three examples, the QMUL one is a bursary scheme whose household income thresholds and bursary amounts haven’t increased since 2018!

Later, Paula Barker (Labour MP for Liverpool, Wavertree) asked Keegan what steps she was taking to help support students with the cost of living.

This time new minister Robert Halfon took the question – reeling off the magic money twig (again), help being provided to meet the cost of energy bills, “special hardship funds”, the fact that tuition fees are being frozen, and the ability for students to “have their living costs support reassessed”.

And after a challenge from shadow minister Matt Western, he repeated the list:

We know that the cost of living is affecting students from all backgrounds, and especially disadvantaged backgrounds. That is why, as I mentioned, students can draw on the £261 million student premium; why students facing hardship can access their university’s hardship fund; why students from disadvantaged backgrounds, who find that their living costs have increased significantly, can apply to have their costs reassessed; and why we have increased the maximum loans and grants by 2.3% this academic year to try to help students. In every possible way we are trying to help students who face financial hardship.

“In every possible way” is clearly a turn of phrase that isn’t really true here – especially when:

- The £261 magic money twig is actually a cut since pre-pandemic and the current crisis, was never meant to be substantially spent on student hardship, and now has to help more students than before the cut;

- The “special hardship funds” are, in fact, university hardship funds for which no additional funding has been provided;

- The help for energy bills for student tenants is either not there if a student’s landlord is on a non-domestic supply, or almost certainly being retained by those who offer “all-inclusive” bills;

- The freezing of fees has been accompanied by stealth changes to the loan system and its repayment threshold that will mean the majority of students pay more in fees over their lifetime, rather than less;

- The ability for students from disadvantaged backgrounds “who find that their living costs have increased significantly to apply to have their costs reassessed” is a straight-up, barefaced lie – we think he means the ability for students to ask the SLC to have their loan reassessed up if their family household has had a drop in income, not a staggering increase in their or the student’s costs;

- No mention, of course, of international students, medical or nursing students, or postgraduates;

- And the increase in maximum loans and grants by 2.3 per cent? Well.

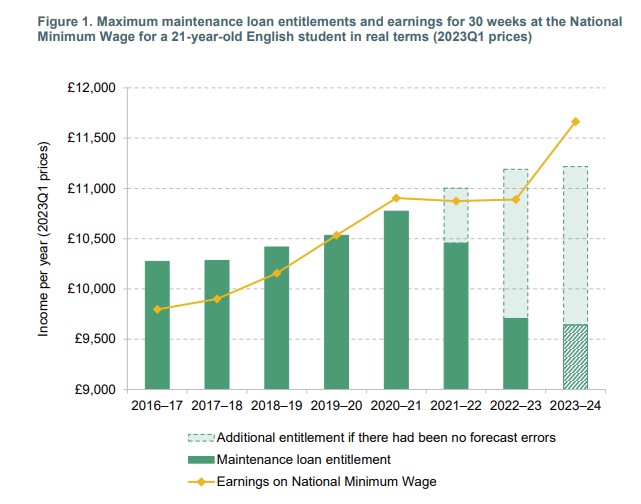

As you’ll remember, the problem with the increase in the maximum loan for the poorest students being so far behind actual inflation is that it means the poorest students have less to live on in real terms.

It is that way because unlike the other ways in which we uprate benefits, it is done by pre-announcing each November (ish) an OBR guesstimate of inflation in sixteen months time taken from eight months ago – and it never corrects when it undershoots.

This morning the IFS has updated its estimate on the real terms cash impact of that problem – and the numbers are devastating. Not only are students – and remember these are students whose family earns less than £25,000 – £1,000 worse off in real terms than they were back in 2021/22, they are £1,500 short when compared to where the max loan should be if it was actually tracking inflation.

Put differently, these students are now £125 per month out of pocket merely because of errors in inflation forecasts – and the comparison with the the National Minimum Wage could not be any more stark:

Correcting the error wouldn’t even be that expensive. IFS says that restoring maintenance loan entitlements this academic year to the same real value they had in 2020–21 would cost £0.9 billion for the cohort that started university in 2022, and correcting forecast errors made in the last two years would cost £1.3 billion for this cohort.

That might sound like a lot, but remember that we are in a year when those stealth changes to repayments means that the government has improved the value of the loan book by £10.7bn.

And of course all of this ignores the fact that the household earnings threshold has been frozen in nominal terms at £25,000 since 2008, amounting to another stealth cut:

As nominal earnings rise, fewer students currently qualify for the maximum each year, and others become eligible for less support – even though their parents may be no better off.”

I know I’m down in the weeds over all this, but I was sketching out some notes about what has happened re student finance since Covid earlier, and it really is astonishing.

- First we ended up delivering a demonstrably thinner higher education experience during the pandemic, gaslit those trying to claim any discounts or refunds over it and made student leaders feel guilty if they campaigned for them;

- Then we introduced a series of stealth changes to student loans Ts and Cs to make sure most will pay more for that experience over their lifetime, not less;

- We made the majority of students move to campus in the middle of the pandemic, then falsely told them that doing so was spreading the virus, then locked them up in that housing harming their mental health in the process, and then told them to pay full price rent even though we asked them not to return to that housing after Christmas;

- Where we nevertheless supported students to achieve to their full potential the regulator regularly insinuated that the results students got were some sort of pity fluke;

- For three years in a row during that crisis and into a separate cost of living crisis, we’ve not uprated the money we loan to them to cover their costs for actual inflation;

- And we’ve spent less on their tuition every year in real terms because the Treasury hasn’t got the courage to admit it’s saving money by thinning out the respective unit of resource;

- All while the only meaningful parliamentary time expended has been to demonise them for daring to have different views on equality and diversity than those 50 years older than them that read the Telegraph.

“In every possible way”, he says. Oh my days.

“the QMUL one is a bursary scheme whose household income thresholds and bursary amounts haven’t increased since 2018!” This applies to student finance in general (and all across the UK). The parental thresholds have not been indexed since 2008 according to the IFS.