The class war is over, said Tony Blair in his speech to the Bournemouth 1999 Labour Conference, as he announced his plan to build a “model 21st century nation” based “not on privilege, class or background” but on “the equal worth of all”.

As part of that plan, he’d lifted a cap on student numbers and proposed that 100,000 more young people go to university in the following two years. He then went further – setting his famous target of 50 per cent going into higher education in the next century.

Over the two decades since, that target on participation was achieved. But the equality and social mobility thing? Not so much – partly because he forgot to account for the unequal financial worth that citizens of the new model nation were starting with, and then also forgot to do anything other than be intensely relaxed about the compound acceleration of property wealth.

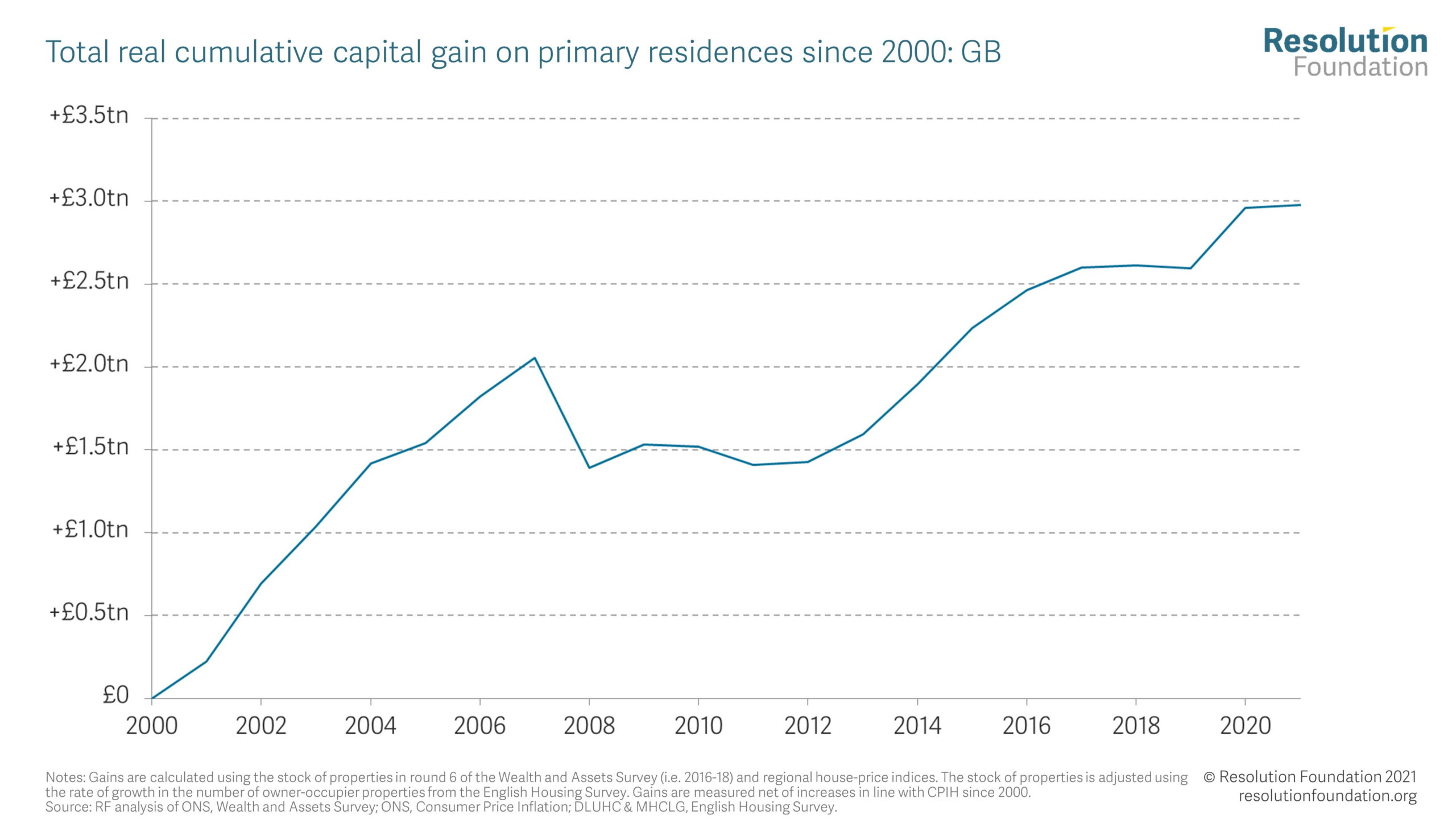

Twenty years on and we can see the miserable results. The Resolution Foundation has published a report that shows that an astonishing 20 percent of the country’s entire wealth is now made up by the increase in house prices since 2000 – wealth that has largely gone to older and richer people, who will pass it down to their children. Wealth that, as RF points out, is unequal, unearned and untaxed.

Social mobility? In those two decades, the least-wealthy third of households have gained less than £1,000 per adult on average from rising house prices this century. The wealthiest 10 per cent, meanwhile, have seen an average gain of £174,000. As for the regional distribution of all this, unsurprisingly it’s the south and east of England that have seen much faster gains since 2000 than other areas of the UK.

With a colossal wealth juggernaut like that accelerating and exacerbating deeply entrenched social immobility, higher education’s cute little “getting on” plans and efforts don’t stand a chance. Because neither human capital nor social capital will get anywhere near financial capital – and anyway, the latter will buy you at least some of the former.

But it’s worse than all that. In a lot of cases, the mere act of higher education participation drives up the wealth further before Charlie Bucket even signs up for their university’s graduate skills award.

No romance without finance

First there’s the income being banked from Charlie’s rent. This year’s NUS/Unipol Student Accommodation Costs Survey shows that student rents have increased by over 60 percent in a decade, and a 16 percent increase on pre-Covid levels.

As we’ve noted here before, both in the purpose-built part of the market and the houses in multiple occupancy part, property ownership is a major investment vehicle – where incomes now (that in turn fuel the purchase of more property) are actually driven by a state-subsidised student contribution scheme that those trying to climb the ladder pay the biggest share of incomes for during their lifetimes. Where’s the value for money debate about that?

But then there’s the value of the property itself that Charlie’s renting. Day one slide one of GCSE economics will tell us that both rent and house prices are likely to rise rapidly if demand outstrips supply. Forget the two decades for a minute – UCAS’ end of cycle report said that acceptances at higher tariff providers by the end of the 2021 admissions cycle were up 11 percent this year, and up 28 percent on 2019.

Guess what happens next in the towns and cities in which these providers are based, to the balance sheet of the property owners, and to the student experience (let alone the social mobility outcomes) of the poorer students at those providers scraping together the rent to push the portfolio values even higher.

Overall, on the assumption that Charlie is someone who’s from a family that hasn’t (relatively) benefitted from the increase in property wealth, the lifetime of graduate contributions depresses the ability to save – yet in doing so the wealth transfer to property owners and investors involved in Charlie’s student accommodation is pretty much instant.

In this scenario, you’d expect ministers whose government is obsessed with “levelling up” to be trying to do all they could to cool the overheating (student) housing market. But instead Michelle Donelan finger wags at universities even daring to consider not taking everyone generated by DfE’s examnishambles, OfS does nothing about universities stretching resources so thin that lectures couldn’t run in-person even without a pandemic, and every day stories about chronic accommodation shortages in our major universities’ towns and cities pop in our feeds.

And yet nobody seems to have a plan.

We’re only wasting time if your pockets are empty

We’ve been over on the site before how we got here, but where we are deserves repeating – and as such this list in the NUS/Unipol report deserves reproducing in full:

- (Student) rent rises continue to outstrip inflation by a big margin

- The ownership and development of student housing gives universities less influence over rent levels and makes them less engaged generally

- Private providers are setting higher annual rents than universities, and continue to focus on en-suites as the new normal and on studios as a premium offering

- The manoeuvrability of universities in setting their own rents is often highly restricted by rent escalators already built into their long-term loan financing deals

- The main tool that private operators use to set rents is the benchmark of what their competitors are charging. This practice has the effect of loosening rent levels from the reality of inflation indices and student budgets

- There is a major shortfall in the amount of affordable accommodation in many localities

- Lower-cost accommodation is disappearing fast, as old university stock falls out of commission and is not replaced

- Rent levels and the actual cost of living generally are becoming ever-more detached from the financial support available to students through the state maintenance loan system

- On its current trajectory, rent rises are on a collision course with the high numbers of less well-off people forecast to enter higher education over the next decade and a half

- The current level of bursaries and similar types of financial support provided by universities and by some private operators is too low to be effective

- There is not enough accommodation (and associated services) to meet the needs of disabled students

That’s work that’s focussed mainly on PBSA and price – but when supply is tight, quality and safety are big issues too. A new report from the National Audit Office (NAO) finds that the way private renting is regulated is not effective in ensuring the sector is consistently fair for renters or that housing is safe and secure- and the Department for Levelling Up, Housing and Communities (DLUHC) does not yet have a detailed plan to address the problems that renters face.

It lacks data on issues where regulatory action may be required (harassment, evictions, disrepair, or on the costs to landlords of complying with obligations), oversees some local authorities that “inspect almost none” of their privately rented properties, finds that tenants face several barriers to enforcing their rights, and says that local authorities aren’t using the powers they have.

Oh – and DLUHC has no formal joint working arrangements with the Department for Education. What a surprise!

Over the years, we’ve heard lots of solutions fall on deaf ears – from government backed schemes that would see more student housing built and owned by universities, to student co-operatives, to rent controls, and even to steps to reduce the number of students leaving home to go to university in the first place.

There were also some solutions in the Augar review that seemed to suggest that better information would drive down costs – although we’ve made that mistake in higher education before, and nobody’s expecting action on student rent to be the centrepiece of the government’s Augar response if it ever comes.

NUS/Unipol says that universities need to reach out more to their private providers, acknowledge that the private sector is housing their students and that there is a duty of care for student welfare irrespective of any contractual relationship. In turn, it says that the private sector should not move outside of its areas of expertise as accommodation suppliers into more complex areas of mental health and student support, “best provided by universities”.

Maybe some or all of the above solutions could work, but you’d need a minister to think it was their job to find a solution first. As the NUS/Unipol report says:

The time is right for greater inter-departmental co-operation around the centre-point that student accommodation is a vital part of the educational venture.

Regardless, there’s one thing that I think just has to happen. It takes us back to that day one, slide one of GCSE economics supply/demand thing. I want to see the plan.

A fly girl like me needs security

When a university recruits a full-time student that isn’t resident in the area, it generates a demand for an associated bedspace (or bespaces when students arrive with families in tow) – and it ought to be relatively straightforward to calculate how many years, on average, those bedspaces will be required for.

What can’t go on is the idea that that demand can be generated without worrying too much about or feeling responsible for available supply beyond “first year guarantee” rooms. That approach is what has caused the mess we are in now – and it’s harming communities, students and the sector’s chances at getting near to “levelling up”.

So in many ways this is really very simple. Every March, every vice chancellor in an area, in tandem with their local authority and local NHS trusts, should be jointly required to develop and publish a plan for scrutiny by their local community and students’ unions that demonstrates confidence that there will be ample medium term bedspace supply for the university’s student recruitment targets (and total “in attendance” students for the period) from the following September.

It should contain a hard limit on the number of “in attendance” students that each university agrees to recruit by the end of clearing, fines and a detailed contingency plan if the number is overshot, some slack in the system to allow for student choice, commitments on support for finding housing if the slack is taken up, and a proper assessment of price range in the supply assessment that is matched to the university’s widening participation objectives.

Put another way, if we’re bringing them to a place, we should be confident they’ll be able to find somewhere to live at a price and standard that we think will allow them to actually succeed as a student. Why on earth would we wait to be forced to do that?

Not all students behave the same, and not all want university provided accommodation, so predicting demand isn’t easy. Also, whilst a few HEIs have full accommodation, many have empty rooms caused mostly by A Level grade inflation pulling 1st year UK students away. Mature students often want to stay with family and commute, leaving a financial hole for the HEI.

It’s a problem that extends well beyond the University that’s getting blamed on the Universities, perhaps rightly so in some cases. A South Coast Russell group University I know only too well started buying up houses around the periphery of the Campus many years ago, many are rented to overseas mature PhD students with families or used as office space if not up to a rentable standard, then as the campus expands they are demolished to make way for ‘new’ Admin, teaching and sports facilities. This puts huge pressure on non-university family home availability. The streets slightly further away, up… Read more »