As international students fall, rents start to fall

Jim is an Associate Editor (SUs) at Wonkhe

Tags

But new figures out from Zoopla in research carried out for the BBC suggest that rents are starting to fall in parts of the UK – and in aggregate rental inflation has reached its lowest level in nearly 3 years.

And one of the culprit causes? Students.

Overall, demand for rented homes has fallen by 39 per cent over the last year, which means Zoopla has shifted its assessment from “red-hot” to “hot”.

17 people are chasing every home for rent, double the pre-pandemic average seen between 2017-2019 – but supply per estate agent has slowly started rising, increasing by 17 per cent in the last year.

That means that rents for new lets have risen by 5.7 per cent over the last 12 months, reaching an average £1,232 per month across the UK.

But in the last 6 months, they’ve risen by just 1.6 per cent, the lowest increase seen since 2021.

And so with the heat coming out of the rental market, Zoopla reckons that that’s all mainly a result of affordability pressures.

It points to a decline in demand from international students and rents “overshooting” the level at which renters can pay.

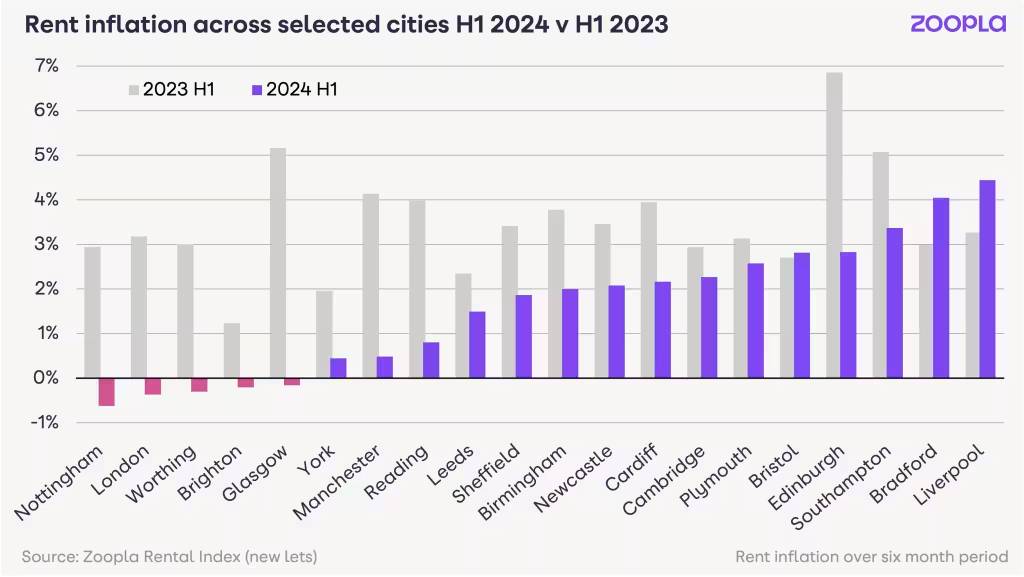

In the first six months of 2024, rents fell in Nottingham, London, Brighton and Glasgow. And rent inflation fell in a whole range of university cities and towns – with only Bradford and Liverpool seeing rent inflation, both of which are widely known to have a surplus of student housing in relation to demand.

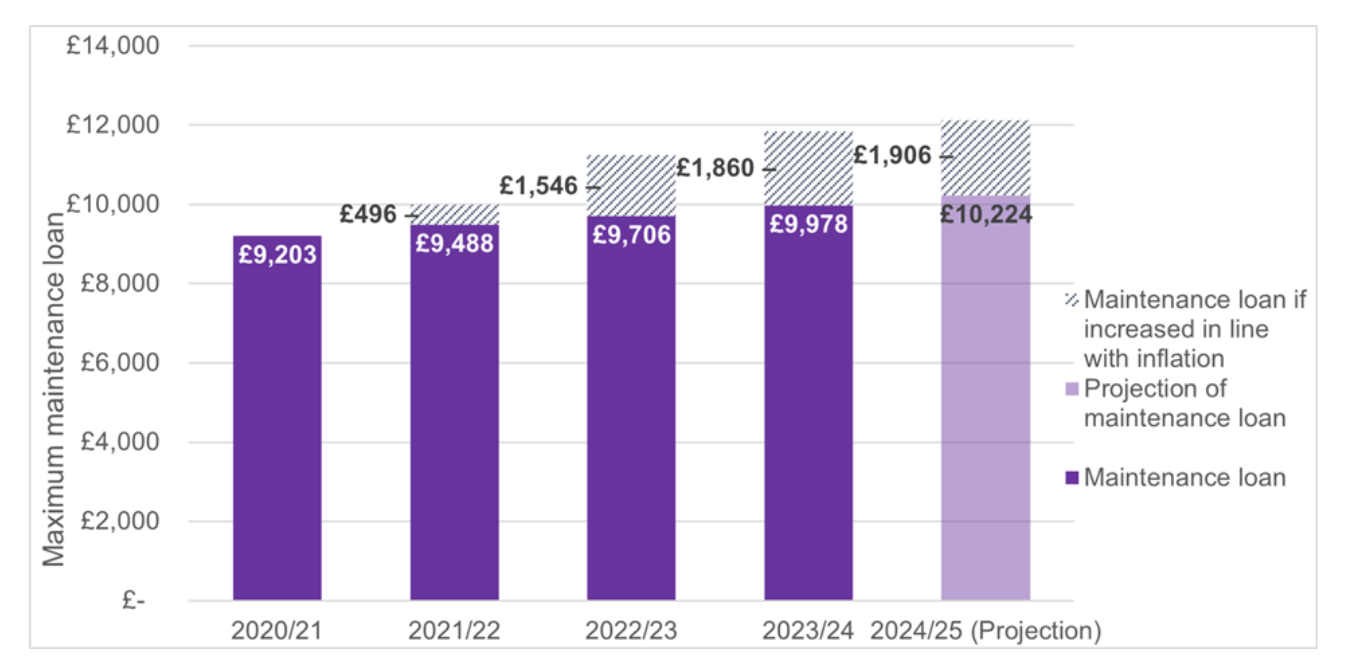

It’s worth remembering that this coming September, the maximum England maintenance loan is almost £2k less than it should have been if the amount had actually risen by inflation since 2020 – and that’s a figure that ignores that the means-test threshold over which family income starts to reduce how much students can borrow remains at the same level as it was in 2007- £25,000.

The straightforward way to read all of this is as follows. The very dramatic increase in bedspace demand caused by the spike in international recruitment since 2019 has helped to heat up the rental market – that’s obviously what happens when you go from 320k visas in 2018/19 to 480k in 22/23, and you add in 137k more dependent visas.

We might assume that the changes to immigration therefore cool the housing market by softening demand for bedspaces – but it’s just as likely that the rents that landlords of both off-street housing and PBSA have been able to enjoy have now reached unaffordable levels – and so that could be cooling the student market.

The figures don’t support the idea that a reversal in the dependant decision would drive demand back to where it was. The figures do support the idea that the UK’s cost of living (including rent levels) and currency exchange rates – especially in Nigeria – are now simply too high to attract the volumes of international students we once were.

This is literally what an Economics GCSE student would tell you what happens when you allow demand to grow so fast – it was a classic bubble, and is now a classic burst one.

And it points us back to the idea that if the sector wants more power over the volumes of students it recruits, it needs to take more responsibility for ensuring that the experience is affordable and that the facilities – both on campus and in the wider community – are sufficient.

This is absolutely true being an international student it’s really hard to pay a lot of rent just for one single room mostly in east London .. Government should have to take some steps kindly