The move to lifelong learning is a critical part of adapting to our changing world.

Average life expectancy in the UK has risen significantly – now, more than 80 per cent of people reach the state pension age of 66, and children born today have a good chance of living to be 100 years old.

This is a fantastic success story, but much of how we structure and organise society is not set up for longer lifespans. With many of us working for longer, we need a system that supports people to learn, upskill and change careers across their lives.

Phoenix Insights is a new longevity think tank set up to deal with exactly these issues. We want to work with government, policymakers, providers and employers, using research and insight to help make lifelong learning a reality. We aim to better understand what real people, including those in the mid to late stages of their career, actually want in this space.

The Department for Education’s Lifelong Loan Entitlement (LLE) consultation gave us our first opportunity to engage with the early stages of its development. We commissioned Public First to conduct a nationally representative, online poll of 2,012 UK adults in April this year alongside four focus groups, focusing predominantly on mid to late stage career workers without a level six qualification or higher. We targeted the focus groups at people who may want or need to retrain because they were in a declining sector, or people who had already made a career move.

Pro lifelong learning

We found the public to be broadly in favour of the core aim of the LLE – introducing greater flexibility into the system. In our polling 75 per cent agreed that “we place too much emphasis on university degrees when many jobs could be done without one.”

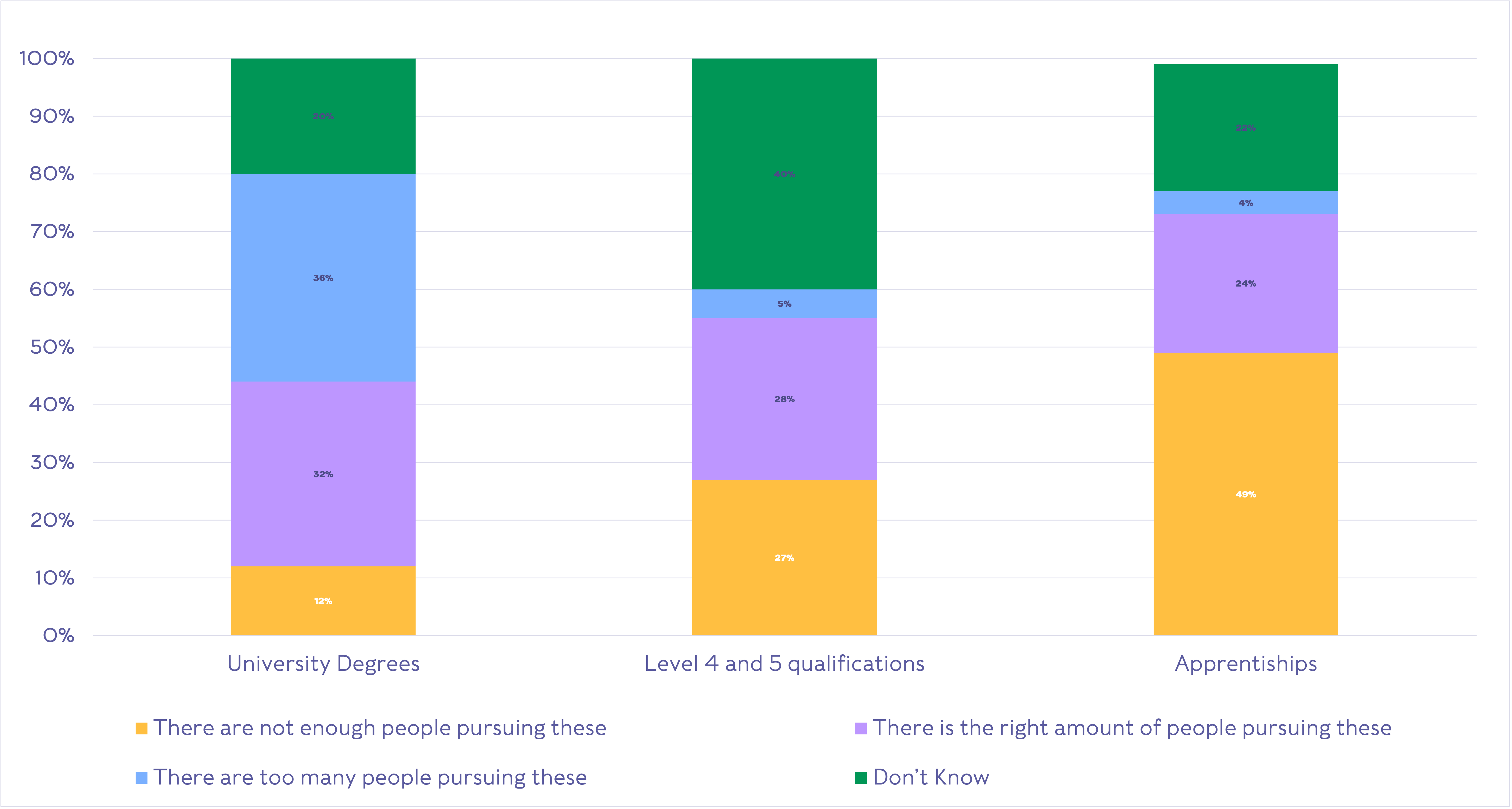

Our polling also found that 36 per cent of people think there are too many people pursuing university degrees, compared to five per cent and four per cent for level four or five qualifications and apprenticeships respectively. However, level four or five qualifications had notably higher “don’t know” responses.

Do you think the right amount of people are pursuing the following types of qualification in the UK?

Our focus group participants had a broadly positive view of retraining and were particularly supportive of flexibility, including combining training with existing work and studying for smaller qualifications/modules.

This can be key for people in mid-life who may be balancing work with caring responsibilities and other commitments:

I had opportunities to go to uni but then I was thinking I don’t want to go away for five years and do this. If they had a shorter version with the same qualification… Then that’s perfect.

Road traffic manager, 52

Anti lifelong loan

However, we found strong apprehension towards the loan element of the LLE, including its name. Many had heard “horror stories” of high levels of interest on student loans and were adamant this was not for them:

…you’re going to be paying this with interest, it could grow every year without you being able to pay it off, and it’s just going to put people off.

Finance manager of an SME, 56Why would you want to incur a debt in your mid-life?

Adult carer, 61

On the name issue, participants barely spotted the word “entitlement” and immediately honed in on the words “lifelong loan”.

One said:

They’ll pass it on to your children, guaranteed. It’s a millstone.

Residential careworker of young adults, 54

In our polling, we tested people’s willingness to retrain and then tested whether the LLE changed this in any way. We found that the offer of the LLE made no statistically significant difference in whether participants would retrain.

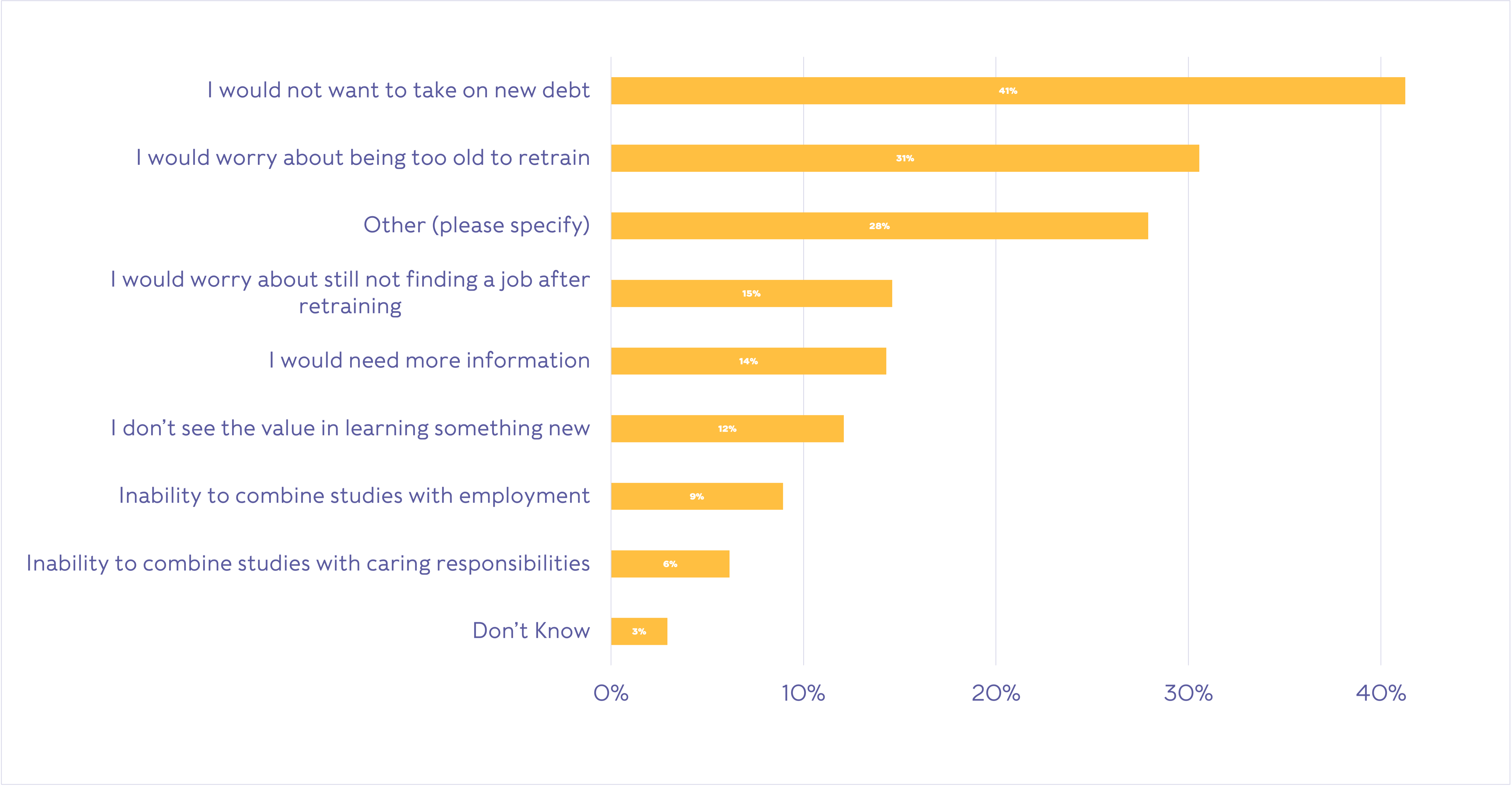

When we asked people who said they would be unlikely to retrain via the LLE why this was the case, by far the most common reason was not wanting to take on new debt (41 per cent) followed by being too old to retrain or upskill (31 per cent).

Reasons given for being unlikely to retrain or upskill with the option of taking a loan under the new Lifelong Loan Entitlement scheme. (Respondents who were unlikely to retrain or upskill)

Overall, the government’s proposals will be key for individuals living and working longer, for employers facing skills shortages, and an economy facing productivity challenges. However, more work needs to be done to make this a genuinely attractive and workable proposition for people, especially those in mid to late career, to take up the offer.

In many EU countries an employee spending money on their own training can deduct the costs of training against their income tax. In the UK this is possible for the employer spending money on training (or even use the Apprenticeship levy) or a self employed person but not an employed person. Perhaps it might be more attractive if the employee could at least treat training costs self incurred as tax deductible expenses? In that way there is no need for a lifelong loan.