It’s a common myth that higher education study in Scotland, without tuition fees, is ‘debt free’. As new figures released today show, that is far from the case. Indeed, student debt in Scotland is rapidly rising, despite the SNP’s policy of free tuition.

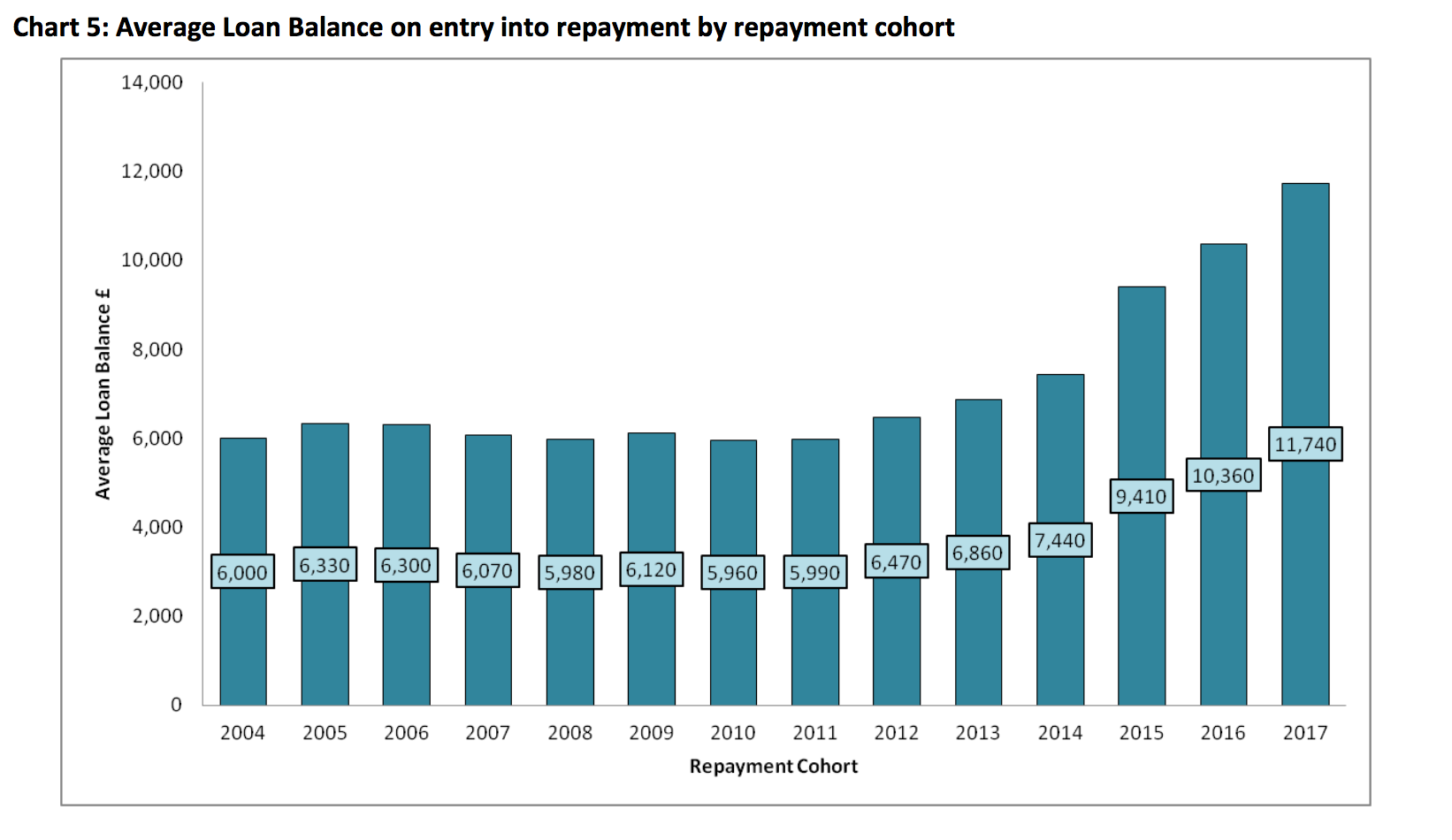

The Student Loans Company has published the average final debt for students who left higher education last year. The figure for Scotland is now £11,740, a dramatic increase of 13.3% on the previous year. The longer term trend is more striking, as the chart below shows. Average final debt has roughly doubled in cash terms (the real terms rise will be less dramatic, but still substantial) since the current Scottish Government entered office in 2007 promising students that it would “dump the debt”.

Source: SLC

The rise since 2012 is due to the changes to student funding implemented in Scotland in 2013 still working their way through. Debt is being pushed up by the substitution of around one-third of the maintenance grant by loans, as well as an increase in the general use of loans to increase living cost support across the board, especially for those from middle-to-high income backgrounds. There’s potential for a further step up next year, when the first cohort on four year courses who have studied wholly under the 2013 reforms will have graduated.

The figure for Scotland remains lower than elsewhere in the UK. That’s partly due to there being no debt attached to tuition fees for those staying here, but the size of that gap with other UK nations is exaggerated by the higher proportion of students in Scotland who leave higher education after doing a one or two year HNC/D. Roughly, it appears to mean that the Scottish average loan debt doesn’t represent the average for those students who complete four years of study, let alone the 1+4/2+3/2+4 models used by half of those moving from college to university.

The next nearest UK nations for debt levels are Wales (£19,280) and Northern Ireland (£20,990). With its £9,000 tuition fee regime pretty much fully rolled out, England now sits £32,220. This figure is set to rise still further, given maintenance grant cuts for new entrants from last autumn, but that won’t show until this group leaves in a few years’ time.

In comparing Scotland and Wales, it’s worth remembering that in Scotland low-income students borrow more than the average each year, while in Wales low-income students borrow less than average due to the more generous grant system available. The Diamond reforms will only accentuate this trend in future years.

So there are a few reasons these figures don’t provide a good guide to the reality of final debt for low-income students leaving university in Scotland, or comparing with other parts of the UK. That won’t stop them being quoted in support of the Scottish status quo. But their limits shouldn’t be forgotten.

This article was originally published on Lucy’s personal blog, Adventures in Evidence.